The weight of a bankruptcy can feel crushing, even after it’s dismissed. While dismissal can be a huge win for your financial future, it often leaves a lingering mark on your credit report, affecting your ability to access loans, rent an apartment, or even secure employment. That’s where a well-crafted letter comes in.

Image: templates.rjuuc.edu.np

I spent countless hours pouring over legal documents and credit reports, finally landing a long-awaited apartment after a lengthy process due to a dismissed bankruptcy on my record. It fueled my passion to create a resource that helped others avoid the same frustration. This article will help you understand how to navigate the process of removing a dismissed bankruptcy and provide a free downloadable PDF template to guide your efforts.

Understanding the Impact of a Dismissed Bankruptcy

A dismissed bankruptcy, though not officially on your record, can still have a negative impact. Credit reporting agencies often struggle to keep up with court actions, leaving these marks on your report. While dismissed, it still reflects negatively on your credit score, making it difficult to secure favorable terms on loans or financial services.

Credit reporting agencies are required to remove inaccurate information from your report. Dismissed bankruptcies fall into this category. However, you need to make a case for the removal by informing them of the dismissal.

Who to Contact About a Dismissed Bankruptcy

There are three major credit reporting agencies: Equifax, Experian, and TransUnion. You’ll need to contact each agency separately to dispute the information.

The Importance of Documentation

To succeed in your quest to remove the dismissed bankruptcy, you need to be prepared. Gathering substantial evidence is vital. Here’s what you need:

- The official court order dismissing the bankruptcy case. This document is the most important piece of evidence. It proves that the bankruptcy was dismissed, and you’re legally entitled to have it removed from your report.

- Your credit report. This will help in identifying the specific instance of the dismissed bankruptcy that you want to remove.

- Anything else that supports your case. This could include official documentation from the court or any communications between you and the creditors involved in the bankruptcy.

Image: envivo.perueduca.edu.pe

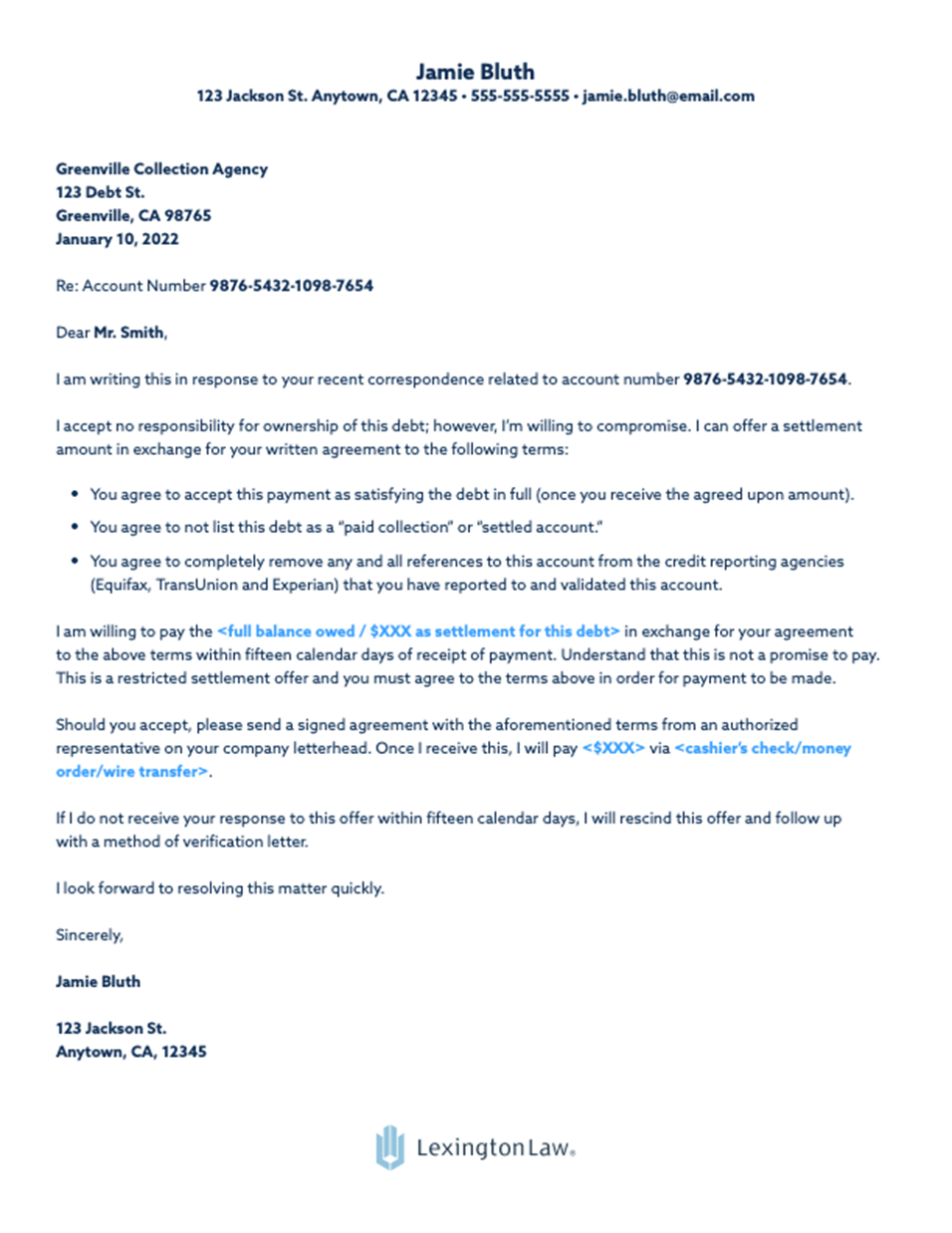

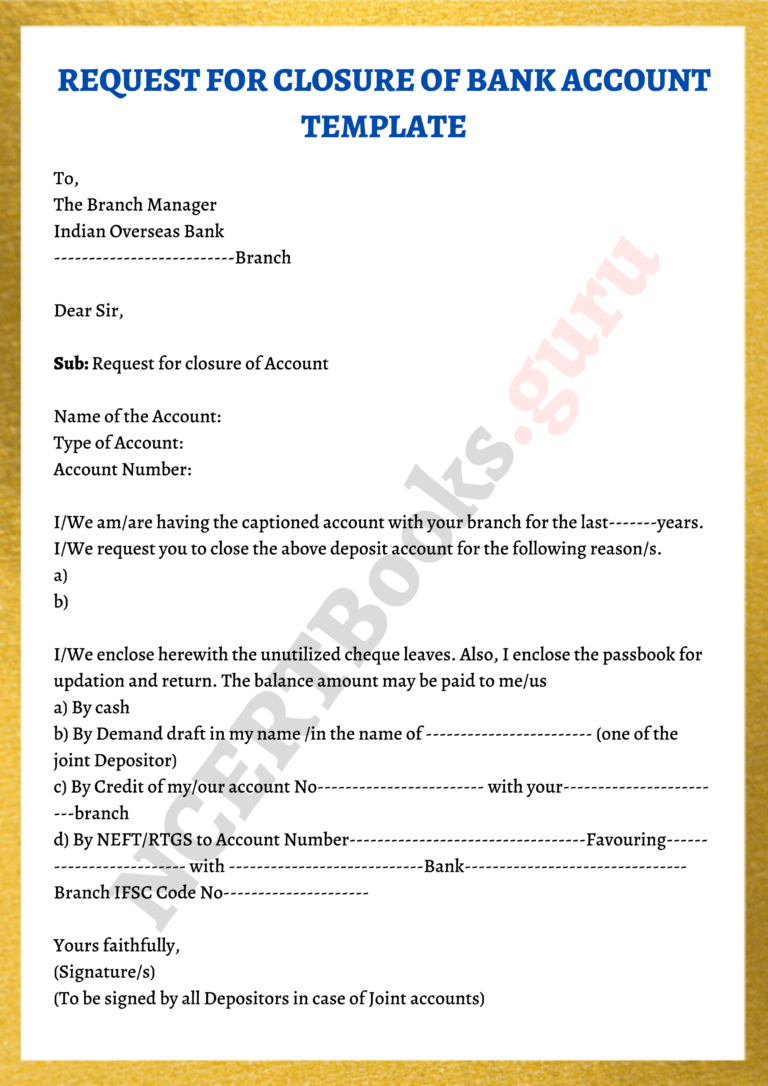

Crafting Your Letter to the Credit Reporting Agencies

Your letter to the credit reporting agencies should be clear, concise, and provide all the relevant information. Here’s a step-by-step guide to crafting an impactful letter:

1. Provide Your Contact Information

Start by providing your full name, address, phone number, and email address. This allows the agency to easily contact you if they need further information.

2. State Your Purpose

Clearly state the purpose of your letter: to request the removal of a dismissed bankruptcy from your credit report. Give the specific date of the dismissed bankruptcy, the case number, and the court that issued the dismissal order.

3. Attach Documentation

Include a copy of the court dismissal order with your letter. This strengthens your case and demonstrates proof of the dismissal. If any additional documents would help, be sure to include them.

4. Ensure Accuracy

Double-check the information you provide in the letter, ensuring everything is accurate and factual. Any mistakes could weaken your case and delay the process.

5. Request Confirmation

Request that the credit bureau confirm the removal of the dismissed bankruptcy from your credit report. This will ensure they acknowledge your request and keep you informed about the progress.

Free PDF Template & Expert Advice

To simplify the process, we’ve created a free PDF template for you to personalize and send to the credit reporting agencies. This template will help you organize your information and ensure you include all the necessary details. Click the download button below to access your free template.

While the letter itself is crucial, understand that credit reporting agencies can take some time to process your request. Be patient, and follow up if you don’t receive a response within a reasonable timeframe. If you still face difficulty, consider seeking help from a credit repair service or an attorney.

FAQ

Q: How long does it take to remove a dismissed bankruptcy from my credit report?

A: It can vary depending on the agency, but generally, it takes about 30 days after they receive your request and supporting documentation.

Q: What if the credit reporting agency denies my request?

A: You have the right to dispute the agency’s decision. You can submit a formal written dispute, providing additional documentation to support your case.

Q: Can I remove a discharged bankruptcy?

A: No, you cannot remove a discharged bankruptcy from your credit report. This information remains on your report for 10 years. However, you can try to improve your credit score by taking steps like paying your bills on time and maintaining a low credit utilization ratio.

Letter To Removing Dismissed Bankruptcies Credit Report Pdf

https://youtube.com/watch?v=t2_NBQHMgo8

Conclusion

Removing a dismissed bankruptcy from your credit report is a task that requires dedication and action. Armed with the knowledge and the free PDF template, you can confidently take the necessary steps to repair your credit score and move forward with a clean financial slate. Don’t let this hurdle prevent you from achieving your financial goals.

Are you ready to start the process of removing a dismissed bankruptcy from your credit report? Let us know in the comments below!