Imagine waking up one morning to find your business bank account drained, with no explanation or warning. This unfortunate scenario, sadly, is a reality for countless businesses that haven’t taken proper precautions to secure their financial assets. Enter the affidavit of prepayment, a powerful tool that can bring peace of mind and safeguard your business’s finances.

Image: www.signnow.com

This article will delve into the world of affidavits of prepayment, exploring their purpose, benefits, and real-world applications. By understanding the power of this legal document, you can take control of your financial security and build a stronger foundation for your business, ensuring your hard-earned money remains safe and accessible.

What is an Affidavit of Prepayment?

An affidavit of prepayment is a sworn statement, typically notarized, that confirms a specific account has been fully paid. This document acts as legal proof of payment, providing irrefutable evidence to protect your financial interests.

Components of an Affidavit of Prepayment:

- Identification of Parties: This section clarifies who is involved in the transaction, including the payer and the payee.

- Description of the Account: Detailed information about the account in question ensures clarity and avoids any potential confusion.

- Statement of Payment: A clear and concise declaration that the account has been fully settled, specifying the date and method of payment.

- Notarization: This crucial step adds an official layer of verification, solidifying the validity of the affidavit.

When is an Affidavit of Prepayment Necessary?

Affidavits of prepayment are essential tools in various financial scenarios. Here are common situations where this legal document is crucial:

Image: www.wikihow.life

1. Protection Against Fraud

An affidavit of prepayment acts as a powerful deterrent against fraudulent activity. If you’ve already paid an invoice, this document can help prevent a vendor from claiming they haven’t received payment, potentially protecting your business from double-billing or unauthorized charges.

2. Secure Business Transactions

Businesses often engage in complex transactions involving large sums of money. An affidavit of prepayment can be crucial in confirming payment upon completion of these transactions, ensuring both parties have a clear and unambiguous record of the financial exchange.

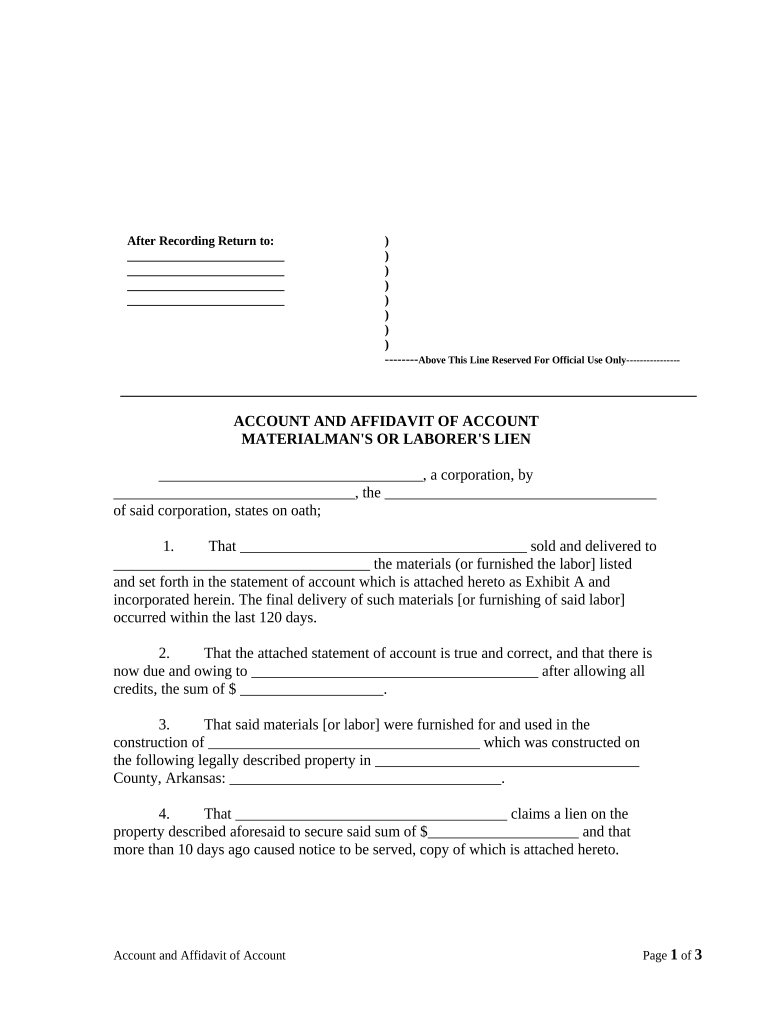

3. Releasing Liens or Encumbrances

In some cases, a lien or encumbrance might be placed on a property or asset until a specific debt is fully paid. Once the account is paid, an affidavit of prepayment can be used to officially release the lien, allowing the owner to access the full value of the property or asset.

4. Clearing Debts for Legal or Financial Purposes

When dealing with legal proceedings or financial transactions, having an affidavit of prepayment can be critical in proving debt settlement. It can be presented in court as evidence of payment, helping to resolve disputes and avoid potential legal repercussions.

The Benefits of an Affidavit of Prepayment

Using affidavits of prepayment comes with numerous advantages, including:

- Enhanced Legal Protection: This document provides concrete proof of payment, protecting your business from false accusations and potential financial losses.

- Increased Transparency: By creating a clear and traceable record of payment, affidavits promote transparency in financial transactions, fostering trust and accountability between parties.

- Reduced Disputes: A well-defined affidavit can help minimize disputes regarding payment, streamlining communication and maintaining a positive relationship between you and your business partners.

- Streamlined Operations: By minimizing the risk of disputes and misunderstandings, affidavits contribute to smoother business operations and a more efficient use of resources.

- Improved Financial Security: Knowing that an affidavit of prepayment safeguards your financial interests can provide peace of mind and allow you to focus on growing your business.

Creating a Strong Affidavit of Prepayment: Key Considerations

For maximum effectiveness, your affidavit must be comprehensive and accurately reflect the details of the payment. Here are essential elements to consider:

- Clarity and Conciseness: Use clear and simple language to avoid any potential ambiguity or misinterpretation.

- Accuracy of Information: Ensure all details presented in the affidavit are accurate and up-to-date, including dates, amounts, and the names of involved parties.

- Proper Formalities: The affidavit should adhere to the legal requirements of your jurisdiction, including proper notarization and witnessing.

- Professional Design: A professional-looking affidavit conveys a sense of credibility and seriousness, strengthening its legal weight.

Real-World Examples of Affidavit of Prepayment

To further illustrate the practical applications of this legal document, let’s consider some real-world examples:

- Contractor Payments: When a business hires a contractor for a project, a signed affidavit of prepayment can be used as evidence of payment upon completion of the work, protecting the business from potential claims of unpaid bills.

- Property Transactions: In real estate transactions, an affidavit of prepayment can be used to release any outstanding mortgages or liens on the property, allowing the sale to proceed smoothly.

- Loan Repayment: For businesses that secure loans, an affidavit of prepayment can be used as a formal document to confirm payment of the loan in full, ensuring the release of any associated collateral.

Affidavit That All Accounts Are Prepaid

Conclusion

By understanding the importance and benefits of an affidavit of prepayment, businesses can bolster their financial security and minimize the risk of disputes and fraudulent activity. This powerful legal document serves as a critical tool for establishing transparency and proof of payment in various financial transactions, allowing organizations to navigate the complexities of business with greater confidence and peace of mind. When used strategically, an affidavit of prepayment can be a powerful shield, protecting your financial interests and empowering you to focus on achieving your business goals.