Have you ever wondered how those seemingly magical credit cards work? How a small swipe can unlock a world of purchases, but also lead to a mountain of debt if not managed carefully? Managing credit is a crucial skill, especially in today’s world where plastic is king. That’s where the NGPF activity bank comes in – a treasure trove of resources designed to equip you with the knowledge and understanding to navigate the complex landscape of credit and make smart financial decisions.

Image: www.studocu.com

This article delves into the heart of the NGPF Activity bank, uncovering its hidden gems and revealing practical strategies to unlock the power of credit while avoiding its perils. We’ll explore engaging activities, insightful simulations, and valuable real-world applications that will transform you into a credit savvy individual.

A Deep Dive into NGPF Activity Bank: Unlocking the Secrets to Credit Management

The NGPF Activity Bank, a brainchild of the Next Gen Personal Finance organization, provides a wealth of free resources that empower individuals to understand and navigate the intricacies of credit. This platform, designed to promote financial literacy, goes beyond dry theory and embraces interactive learning through engaging activities that stimulate critical thinking and decision-making skills.

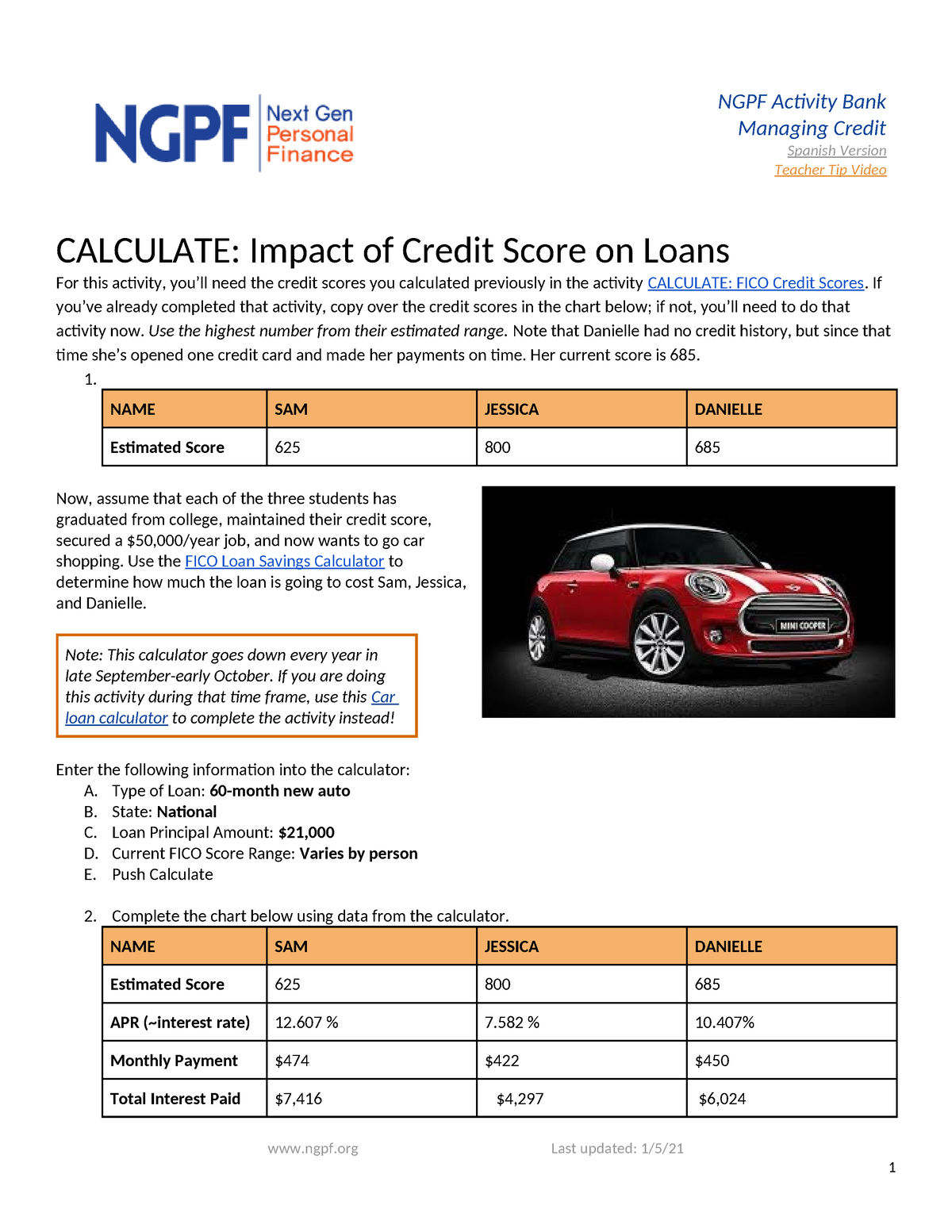

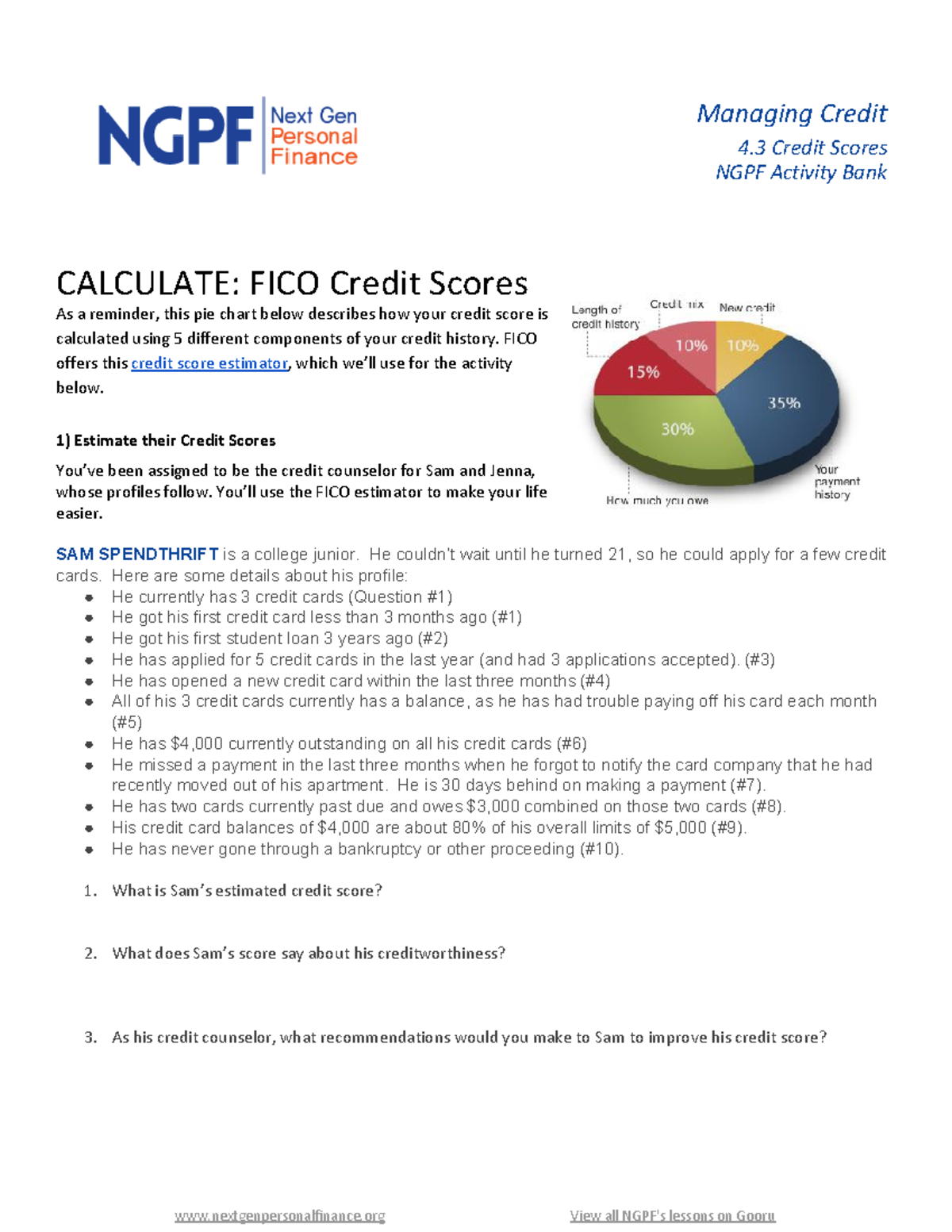

One of the bank’s cornerstones is credit score understanding, an essential element of financial well-being. This is where the Credit Score Challenge comes into play, an interactive simulation that immerses participants in the process of building a healthy credit score. Through this experience, you’ll gain a deeper appreciation for the factors that influence your creditworthiness, such as payment history, credit utilization, and length of credit history.

Another vital aspect of credit management is responsible utilization. The NGPF activity bank tackles this through the Credit Card Game, a fun and interactive exercise where you assume the role of a credit card user and make choices that impact your financial well-being. This engaging experience illustrates how seemingly small purchases can quickly accumulate interest and debt, driving home the importance of responsible borrowing and budgeting.

Furthermore, the NGPF Activity Bank tackles the impact of borrowing through the Debt Simulation, an enlightening activity that showcases how different loan types impact both monthly payments and the overall cost of borrowing. This simulation allows you to experiment with different loan options and witness the long-term consequences of credit decisions, empowering you to make informed choices that align with your financial goals.

Beyond Simulations: Real-World Applications of Credit Management

The NGPF Activity Bank isn’t just about learning; it’s about applying those lessons in practical ways. Through resources like the Credit Card Comparison Worksheet, you can develop the skills to analyze different credit card offers and find a card that aligns with your needs and financial goals. This tool provides a structured framework for comparing interest rates, annual fees, reward programs, and other key factors, helping to ensure that you choose a card that works for you instead of against you.

Another real-world application lies in understanding the power of credit building. The NGPF Activity Bank provides frameworks for building a positive credit history, highlighting the importance of responsible borrowing, paying bills on time, and managing credit utilization. These strategies can make a significant difference in accessing loans, obtaining better interest rates, and ultimately achieving your larger financial goals.

Expert Insights: Credit Management Strategies That Work

Navigating the world of credit effectively hinges on the right approach. Experts often emphasize the importance of understanding your credit report, a document that reflects your financial history and serves as a roadmap for improvement. They recommend regularly reviewing your credit report for any errors or inconsistencies, as a single error can have a negative impact on your score.

Furthermore, financial literacy gurus advocate for the art of budgeting, a fundamental element of credit management. By creating a realistic budget that allocates spending and tracks income, you can ensure that your credit card usage remains within your financial capacity.

Image: www.studocu.com

Ngpf Activity Bank Managing Credit Answers

Taking Control of Your Credit Journey

The NGPF Activity Bank empowers individuals with the tools, knowledge, and practical skills to navigate the complex world of credit and make informed financial decisions. By engaging with the activities, exploring real-world applications, and applying expert insights, you can build a strong foundation for your financial well-being.

Remember, credit is a powerful tool when wielded responsibly. Embrace the resources available through the NGPF Activity Bank and begin taking control of your credit journey today. Your future financial success could depend on it.