Have you ever received a credit report and felt a sense of shock or disbelief? Maybe you spotted a mistake, an entry you didn’t recognize, or an outdated debt that shouldn’t even be there. This feeling of confusion and frustration is something many people experience when dealing with their credit reports. Thankfully, there’s a powerful tool available to help you fight inaccuracies: the Fair Credit Act 604 Form. This form, formally known as the “Request for Investigation of the Accuracy of a Credit Report,” acts as your weapon in the battle for a clean and accurate credit history.

Image: www.saran2.com

Imagine you’re meticulously reviewing your credit report, preparing for a big financial decision like buying a house, only to find a debt that isn’t yours. The stress and anxiety of potentially jeopardizing your financial future can be overwhelming. Luckily, the Fair Credit Act 604 Form gives you the right to challenge incorrect information and have it investigated, putting you back in control of your financial narrative.

Understanding the Power of the Fair Credit Act 604 Form

The Fair Credit Act 604 Form is your lifeline in the realm of credit reporting errors. It’s a crucial part of the Fair Credit Reporting Act (FCRA), a federal law that ensures fair and accurate reporting of your credit history. This form is essentially your official complaint to the credit reporting agencies (CRAs) – Equifax, Experian, and TransUnion – allowing you to dispute any inaccuracies you find in your credit report.

Think of this form as a formal request for a thorough investigation. When you submit the form, the CRA is obligated to investigate the disputed item and, if necessary, correct it. It’s a potent tool to address issues like:

- Incorrect personal information: Mistakes in your name, address, Social Security number, or date of birth can affect your credit score.

- Unrecognized debts: A debt that’s not yours, a debt that’s already paid, or a debt that doesn’t belong to your correct account.

- Outdated information: Debts that are older than seven years (excluding bankruptcies, which have longer reporting periods) are typically not considered for scoring.

- Fraudulent entries: If someone is using your identity to open accounts or acquire credit, you need to immediately report the issue and dispute these entries.

- Incorrect account activity: Mistakes in the date or amount of a transaction, late payment marks, or other misleading information need to be corrected.

How to Use the Fair Credit Act 604 Form

The Fair Credit Act 604 Form is a structured document with sections that guide you through the dispute process. Here’s how to navigate it effectively:

- Download the Form: You can find the form on the websites of each CRA or the Federal Trade Commission (FTC). It’s critical to complete the form accurately and thoroughly.

- Provide your personal information: Begin by clearly and accurately listing your name, address, phone number, and Social Security number.

- Identify the specific dispute: Clearly mention the details of the error including the CRA name, account number, type of debt, and specific reason for the dispute. Provide all available supporting documentation.

- Sign and date the form: Legibly sign and date the form before submitting it by mail, fax, or through the CRA’s website.

- Keep a copy: Always keep a copy of the completed form for your records to track the progress of your dispute.

Beyond the Form: The Dispute Process

Once you’ve submitted your 604 Form, the responsible CRA has 30 days to investigate your dispute. They will contact the information provider, the company that initially reported the information, and work to resolve the issue. During this period, you can track the progress of your dispute by calling the CRA and providing your case number.

If the CRA finds your credit information is inaccurate, they’ll correct your credit report. However, if the CRA determines the information is accurate, they’ll inform you of their decision and provide you with a summary of their investigation. Even if the dispute is denied, you retain the right to include a 100-word statement explaining your position within your credit report.

Remember, your credit score is a crucial factor in accessing loans, mortgages, credit cards, and other financial products. Ensuring the accuracy of your credit report is a fundamental step in safeguarding your financial well-being. The Fair Credit Act 604 Form offers you the power to challenge inaccuracies and empower yourself to achieve a clean and accurate credit history.

Image: materialschoolwexler.z4.web.core.windows.net

Your Rights and Strategies for Successful Disputes

The Fair Credit Reporting Act gives you significant rights when disputing inaccurate information on your credit report. Here’s a breakdown of your key rights:

Your Rights under the Fair Credit Reporting Act

- Right to a free annual credit report: You are entitled to receive a free copy of your credit report from each of the three major CRAs annually. This is essential for detecting any errors early.

- Right to dispute inaccuracies: The FCRA grants you the right to dispute inaccurate information on your credit report using the 604 Form.

- Right to know the source of credit information: You have the right to know what companies provided information about your credit history.

- Right to a summary of the investigation: When you file a dispute, you’re entitled to receive a summary of the investigation’s results from the CRA.

- Right to add a statement: If the CRA concludes the information is accurate, you have the right to add a statement to your credit report explaining your side of the story.

Expert Tips for Winning Your Credit Dispute

Successfully resolving a credit dispute requires a combination of meticulous preparation, careful documentation, and assertive communication. Here are expert tips for maximizing your chances of success:

- Gather all relevant documents: Document everything related to the dispute, including copies of your credit report, statements from your creditors, and any other supporting documents.

- Be clear and concise: When filling out the 604 Form, be specific and use clear language to explain the error. Avoid using vague terms or making assumptions.

- Communicate with all parties: Keep both the CRA and the information provider updated on your progress and any relevant information.

- Follow up regularly: Check the status of your dispute periodically, and don’t be afraid to follow up if you feel your case isn’t receiving enough attention.

- Be persistent: Don’t give up if your dispute is denied initially. You have the right to appeal the decision or file a complaint with the Consumer Financial Protection Bureau.

Frequently Asked Questions

Q: What if I disagree with the CRA’s decision on my dispute?

If the CRA rejects your dispute, you still have options. You can request a reinvestigation, meaning the CRA will review your dispute again. You can also file a complaint with the Consumer Financial Protection Bureau (CFPB) or the FTC, which can help resolve your dispute.

Q: How long does it take for a credit dispute to be resolved?

The CRA has 30 days to investigate the disputed item. However, it can take longer if the issue is complex or requires additional information. You can track the progress of your dispute by contacting the CRA and providing your case or investigation number.

Q: How often can I dispute information on my credit report?

You can file a dispute as often as necessary, but keep in mind that too many frivolous disputes can raise a red flag with the CRAs. It’s crucial to only file disputes for legitimate errors and to ensure that your documentation is accurate and relevant.

Q: What happens if my dispute is successful?

If the CRA confirms the information is inaccurate, they will update your credit report and send you a corrected copy. You should also receive an updated credit score reflecting the changes.

Q: Can I use the 604 Form to remove accurate information from my credit report?

No, the 604 Form is only for disputing inaccurate, incomplete, or unverifiable information on your credit report. You cannot use this form to remove legitimate and accurate information.

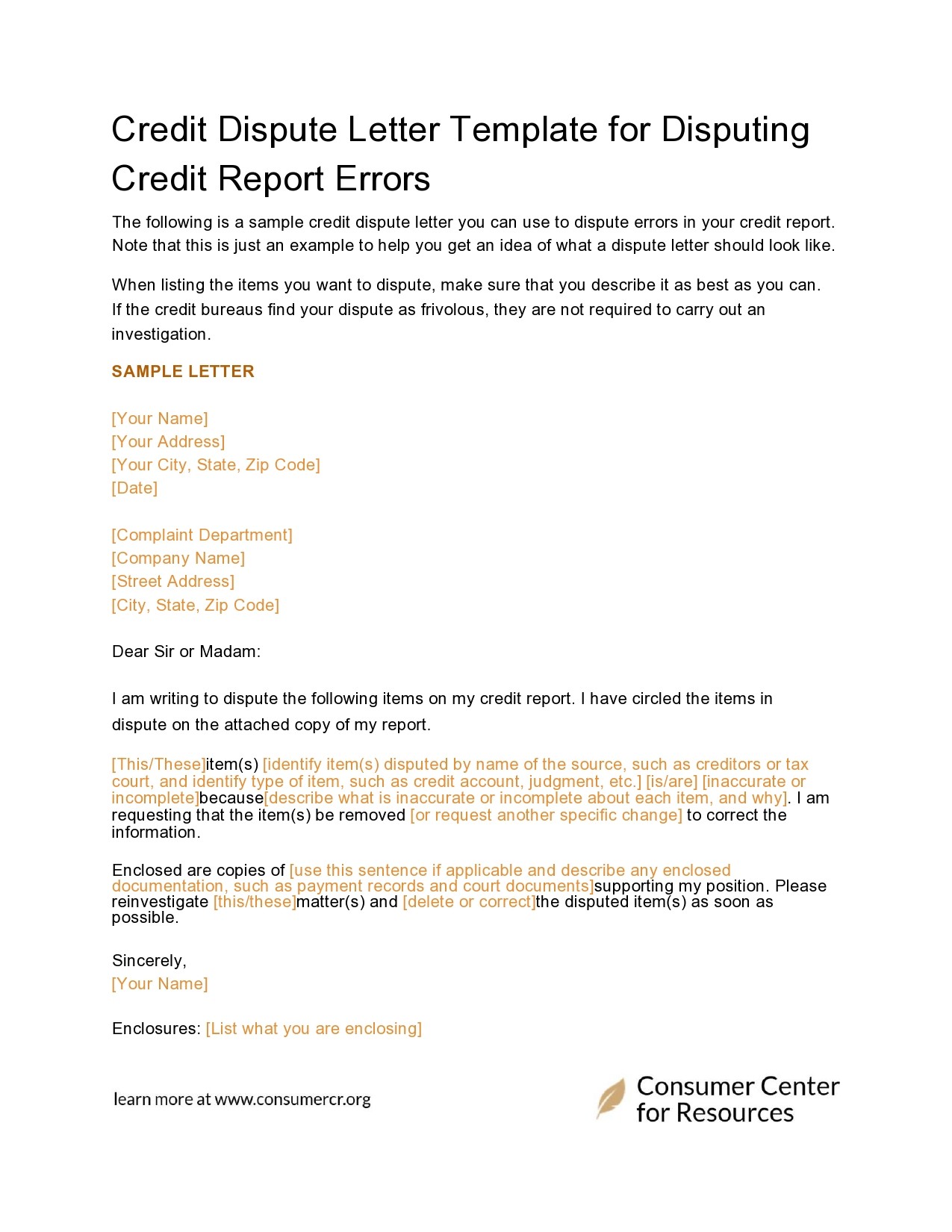

Fair Credit Act 604 Form Pdf

Empowering Yourself with Accurate Credit Reporting

The Fair Credit Act 604 Form is a powerful tool for rectifying credit reporting errors. By understanding your rights and utilizing this form effectively, you can ensure your credit report reflects your true financial picture. So, take the time to review your credit report regularly, and remember, you have the power to fight for a clean and accurate credit history.

Are you interested in learning more about how to effectively use the Fair Credit Act 604 Form?