Navigating the world of insurance can be tricky, and sometimes we find ourselves needing to cancel policies. Maybe your needs have changed, maybe you found a better plan, or perhaps you simply want to save some money. Whatever the reason, knowing how to properly cancel your insurance is important to ensure a smooth transition and avoid any unwanted charges or complications.

Image: lettersfree.medium.com

Writing a letter of cancellation is a formal way to communicate your decision to your insurance provider. It serves as a documented record of your request, protecting you from any potential disputes or misunderstandings. But crafting an effective cancellation letter requires careful attention to detail to ensure your request is clear, concise, and properly delivered.

Understanding the Basics: What is a Letter of Cancellation of Insurance Policy?

Defining the Purpose

A letter of cancellation of insurance policy is a formal communication to your insurance provider, notifying them of your intention to terminate your insurance coverage. It outlines the specific policy you wish to cancel, the effective date of the cancellation, and any relevant information like your policy number or account details.

Importance of a Written Request

While some insurance companies allow cancellation over the phone, submitting a written letter is always recommended. A written letter acts as a documented record of your request, offering protection against misunderstandings or claims that your cancellation wasn’t properly communicated. It can be valuable evidence should any disputes arise about the cancellation process.

Image: www.pinterest.ph

Benefits of a Well-Drafted Letter

A well-drafted letter of cancellation can streamline the cancellation process. By clearly and accurately detailing your request, you can help your insurance provider process your cancellation quickly and efficiently, preventing potential delays or additional charges.

Essential Elements of a Letter of Cancellation

When constructing your letter of cancellation, there are key elements to include for a comprehensive and effective communication:

1. Your Contact Information

Begin the letter by providing your full name, address, phone number, and email address. Ensure all of this information is accurate and up-to-date for clear communication with the insurer.

2. Insurance Company Details

Include the name of the insurance company, the address of the relevant branch or department, and any specific contact person if applicable. This ensures your letter reaches the correct destination for immediate action.

3. Policy Details

Clearly state the specific policy you wish to cancel, including the policy number, type of insurance (e.g., health, auto, home), and the effective date of the policy. This information helps the insurance company identify the correct policy and expedite the cancellation process.

4. Date of Cancellation

Specify the requested date of cancellation. This date marks the point at which your insurance coverage will officially end. Refer to your policy documents or contact the insurance company to understand the required notice period and any potential cancellation fees.

5. Reason for Cancellation

While not mandatory, including a brief explanation of the reason for cancellation can help the insurance company get a better understanding of your situation. You can mention finding a new insurer, a change in your needs, or simply a decision to discontinue the policy.

6. Request for Confirmation

End the letter by respectfully requesting a written confirmation of your cancellation request. This ensures you have documentation of the cancellation process and can be helpful if any issues arise in the future.

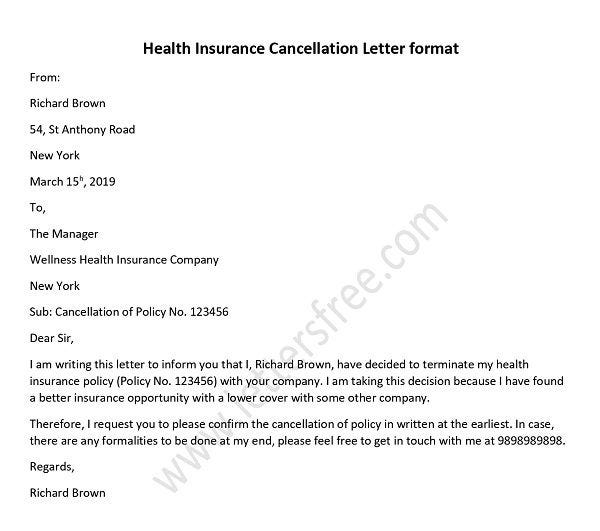

Sample Letter of Cancellation of Insurance Policy

To help you get started, here’s a sample letter you can use as a template:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address][Date]

[Insurance Company Name]

[Insurance Company Address]Subject: Cancellation of Insurance Policy [Policy number]

Dear [Insurance Company Name],

This letter serves as a formal notification that I wish to cancel my insurance policy, [policy number]. The type of insurance is [type of insurance], and the effective date of the policy is [effective date]. I request that the cancellation be effective from [cancellation date].

Please confirm receipt of this request and provide any necessary information regarding the cancellation process, including potential fees or outstanding balances. I would appreciate a written confirmation of the cancellation upon its completion.

Thank you for your time and assistance.

Sincerely,

[Your Name]

Tips for Writing an Effective Cancellation Letter

To ensure your cancellation letter is clear, concise, and effective, consider these tips:

1. Clarity is Key

Use simple and straightforward language, avoiding technical jargon or complex phrasing. Keep your letter brief and to the point, ensuring your cancellation request is easily understood. Avoid any unnecessary details or personal opinions, focusing on the essential information required for processing your request.

2. Proofreading is Essential

Before sending your letter, carefully proofread it for any errors in grammar, spelling, or punctuation. A well-written letter reflects professionalism and shows your seriousness toward the cancellation process. Ensure all information is accurate and complete before sending it to avoid any confusion or delays.

3. Consider Registered Mail

Sending your letter via registered mail ensures the insurance company receives it, confirming delivery and protecting you from claims of non-receipt. This method provides a trackable record of the letter’s journey, offering additional security and peace of mind.

4. Keep Copies

Always retain a copy of your cancellation letter for your own records. It serves as documentation of your request and can be beneficial if any issues arise or if you need to refer back to the details later.

Cancellation FAQs

1. What happens to my insurance coverage after cancellation?

Your insurance coverage will end on the effective date of cancellation you specified in your letter. It’s essential to ensure you understand any implications of cancellation, such as potential penalties or refunds, and to find alternative coverage if needed.

2. Can I cancel my policy before the end of the term?

Yes, you can typically cancel your policy before the end of the term, but you may be subject to cancellation fees or prorated refunds depending on your policy’s terms. Check with your insurer for their specific cancellation policy and any associated charges.

3. What documents are required for cancellation?

Beyond your formal letter of cancellation, you might be required to provide additional documents depending on the specific policy and the insurer’s requirements. These might include photo ID, proof of address, or a cancellation form provided by the insurance company.

4. What if I have an outstanding claim?

If you have an ongoing claim, the cancellation process may be affected. Check with your insurer to understand their procedures for cancelling with an active claim. Your cancellation request might be processed after the claim is settled or may require additional steps.

Letter Of Cancellation Of Insurance Policy Sample

Conclusion

Writing a letter of cancellation of insurance policy is a crucial step in ending your coverage. By following the tips and using the sample provided, you can craft a formal and effective letter that ensures your cancellation request is clear, concise, and well-documented. Remember, always retain a copy of your letter and double-check your insurance company’s cancellation policies before proceeding.

Are you interested in learning more about specific insurance cancellation policies or have any questions about your particular situation? Feel free to share your inquiries in the comments below!