Imagine sending a large sum of money across borders, continents even. Perhaps it’s for a dream vacation, a down payment on an overseas property, or even a heartfelt gift for a loved one abroad. Such transactions demand a delicate blend of trust and precision, and few institutions embody this more than Wells Fargo. But navigating the labyrinthine process of international wire transfers can feel daunting. This guide, tailored for the Wells Fargo user, aims to demystify the process by highlighting the vital role of the wire transfer form, a document that ensures your money reaches its intended recipient safely and efficiently.

Image: www.flickr.com

The Wells Fargo Wire Transfer Form (PDF) serves as your blueprint for electronically transferring funds. It’s a crucial document that outlines the details of your transaction, acting as a vital communication tool between you, Wells Fargo, and the receiving bank. This comprehensive guide will delve into the intricacies of this form, exploring its key sections, offering practical tips for seamless completion, and providing insights into navigating potential complexities. By understanding this form’s nuances, you can gain peace of mind knowing your funds are on their way to their designated destination.

The Wells Fargo Wire Transfer Form: Your Passport to Global Financial Agility

The Wells Fargo Wire Transfer Form (PDF) is a document designed to ensure accuracy and security in your international money transfers. It essentially functions as a roadmap for your transaction, guiding the money from your Wells Fargo account to the designated recipient’s bank. Let’s break down its critical components and understand their significance:

1. Sender Information:

- Account Number: This section demands precision. Double-check your Wells Fargo account number, ensuring it accurately reflects the source of the funds. An incorrect number can disrupt the entire transfer process, leading to unnecessary delays.

- Contact Information: Your name, address, and phone number are crucial for contact purposes throughout the transaction. This is especially vital if there are any inquiries or issues that need immediate resolution.

2. Recipient Information:

- Beneficiary’s Name: Providing the recipient’s name exactly as it appears on their bank account is paramount. Any discrepancies can lead to rejection by the receiving bank.

- Beneficiary’s Bank: Clearly specify the recipient’s bank name, along with their SWIFT code (Society for Worldwide Interbank Financial Telecommunication). This unique code identifies the receiving bank on a global scale.

3. Transfer Details:

- Amount: Carefully enter the desired transfer amount in the designated currency. Avoid mistakes here, as an incorrect amount could result in an unwanted shortfall or excess.

- Currency: Choose the correct currency for the transaction. A mismatched currency could result in costly conversions and unexpected charges.

- Instructions: This section is crucial for specific details. If there are any special instructions for the beneficiary, clearly indicate them here. This enhances clarity and minimizes potential misunderstandings.

4. Confirmation and Security:

- Signature: Your signature on the form confirms that you authorize the wire transfer, acting as a crucial verification step in the process.

- Security Features: Wells Fargo may implement security measures, such as a security code or additional verification steps, to prevent unauthorized transactions. Cooperate with these measures, as they are meant to protect your funds.

Navigating the Form: Tips for a Smooth Transaction

Completing the Wells Fargo Wire Transfer Form (PDF) may seem straightforward, but there are a few nuances to ensure the transaction proceeds without a hitch:

- Accuracy is Paramount: Diligence is key. Carefully review every detail on the form before submission. Double-check account numbers, beneficiary information, and amounts to prevent any potential errors.

- Seek Clarification: If you’re unsure about any section, don’t hesitate to reach out to a Wells Fargo representative. They can guide you through the nuances of the form and ensure a successful transaction.

- Be Aware of Fees: Wells Fargo may charge fees for wire transfers. Inquire about specific costs associated with your transaction to avoid any surprises.

- Timing and Turnaround: International wire transfers can take a few business days to complete. Factor in this time frame for your transaction, ensuring the recipient has enough time to receive and process the funds.

- Document Your Transaction: Keep a copy of the completed wire transfer form and any confirmation documents for your records. This provides a vital trail for tracking the transaction and resolving any potential issues.

Expert Insights and Actionable Advice

From a financial expert’s perspective, the Wells Fargo Wire Transfer Form’s accuracy is paramount. “It’s like a passport for your money,” explains Emily Carter, a certified financial planner. “Ensure the details are correct, and your funds will reach their destination promptly and securely.”

If you’re sending a large sum of money, Carter recommends considering Wells Fargo’s international wire transfer services, which offer enhanced security measures and expedited processing. “They have dedicated teams who can assist you with complex international transactions, ensuring a seamless and stress-free experience,” she says.

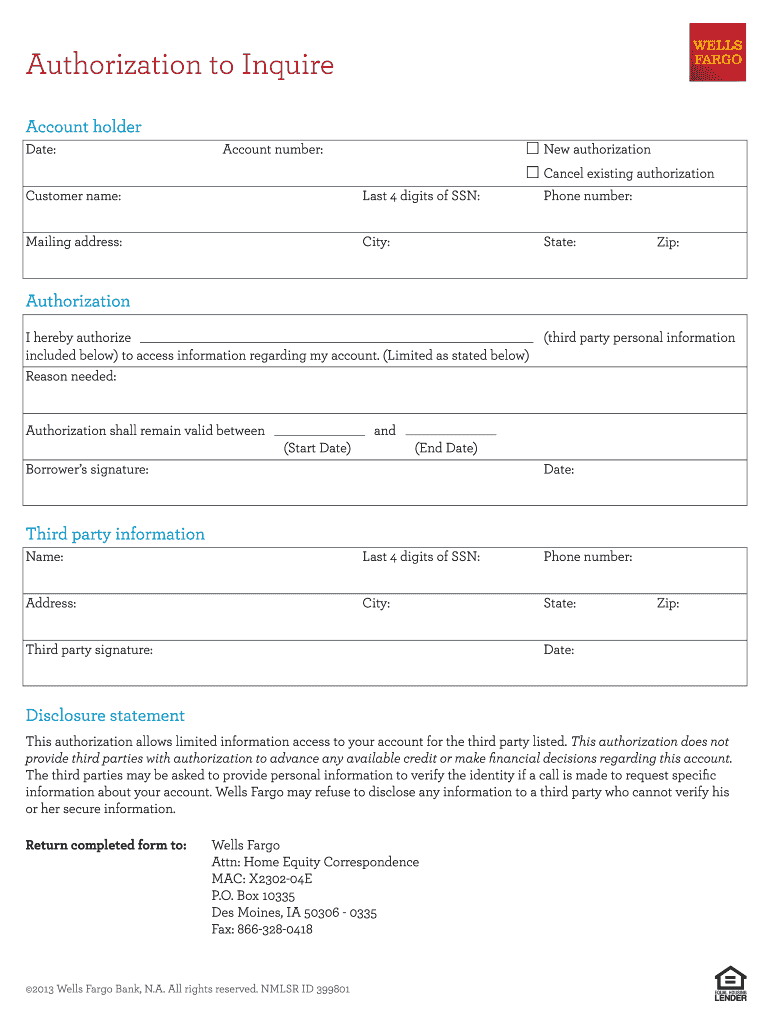

Image: www.signnow.com

Wells Fargo Wire Transfer Form Pdf

Conclusion: Embarking on Your Financial Journey

The Wells Fargo Wire Transfer Form (PDF) is your key to unlocking the potential of international financial transactions. By understanding its components, navigating its details, and seeking clarification when needed, you can navigate these transactions with confidence. Remember, accuracy, diligence, and communication are your allies in ensuring a smooth and successful international money transfer.

Ready to embark on your own financial journey? The Wells Fargo Wire Transfer Form (PDF) awaits you, ready to guide your funds across borders and fulfill your global financial aspirations.