The world of finance can be daunting, filled with jargon and complex strategies that seem reserved for seasoned professionals. But what if I told you that there’s a way to tap into the beating heart of the market, gleaning insights from the very essence of its pulse, and potentially turning a profit while doing so? This is the promise of order flow trading, a technique that allows you to decipher the hidden messages within the flow of buy and sell orders, gaining a unique edge in the financial markets.

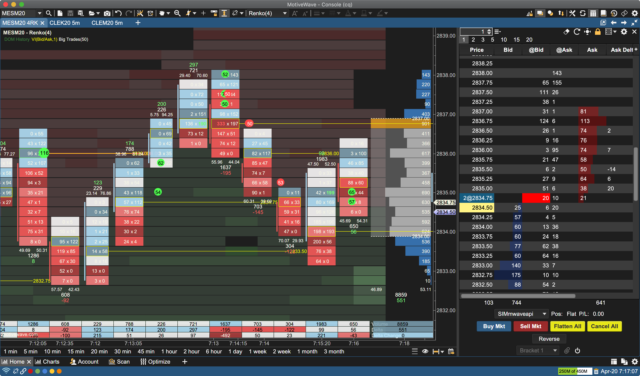

Image: support.motivewave.com

My own journey into the world of order flow trading began with a simple question: “How can I make my trades more informed and potentially more profitable?” I stumbled upon the concept, initially intrigued by its promise of unraveling the true market dynamics. What started as an exploration soon blossomed into a passionate pursuit, leading me to meticulously study the nuances of order flow analysis. And let me tell you, the insights I discovered have revolutionized my trading approach, revealing patterns and trends that I would have never seen before.

Unmasking the Order Flow: A Deeper Understanding of Market Psychology

Imagine a bustling marketplace where vendors and buyers constantly interact, their actions dictating the price of goods. This is the essence of order flow trading – understanding the interplay between buy and sell orders, deciphering the motivations behind them, and ultimately anticipating market trends. Order flow analysis goes beyond simple price charts, diving deep into the individual orders placed by market participants.

Think of it as an X-ray into the market’s hidden intentions. Instead of just observing the price fluctuations, we’re looking at the underlying forces driving those changes. This allows us to identify potential market turning points, understand the strength of price movements, and even anticipate the direction of future trends. It’s like having a secret decoder ring, unlocking the language of market psychology.

Deciphering the Order Flow: Tools and Techniques

The world of order flow trading is rich with tools and techniques, each adding unique insights to the market’s behavior. Here are some key components that form the foundation of this intriguing trading approach:

Order Book Analysis:

The order book is a real-time snapshot of all outstanding buy and sell orders. Analyzing the order book allows traders to identify areas of strong support and resistance, gauge the depth of market sentiment, and potentially anticipate upcoming price movements. For example, a large influx of buy orders at a specific price level can indicate a potential breakout, while a concentrated cluster of sell orders may signal a potential reversal.

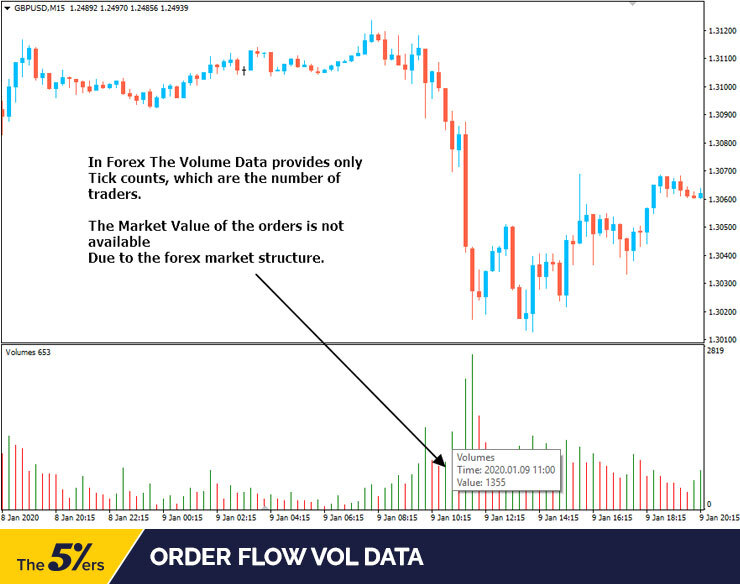

Image: the5ers.com

Volume Profile:

The volume profile, a visual representation of trading volume at different price levels, helps to identify areas of high interest and activity. Areas with a high concentration of volume suggest strong support or resistance, while lower volume zones may indicate a lack of conviction in the market’s direction. This information can help traders identify potential price reversal points and understand the strength of a particular trend.

Tick Charts:

Tick charts, which plot each price tick, offer a granular view of market activity. These charts can pinpoint rapid price changes and identify areas of significant price action, giving traders a deeper understanding of the market’s short-term fluctuations. This heightened awareness can lead to quicker decision-making and potentially more profitable trades.

Order Flow Indicators:

A variety of order flow indicators have been developed to quantify and visualize the dynamic interplay of buy and sell orders. These indicators can help traders identify hidden market imbalances, spot potential divergences between price action and order flow patterns, and ultimately make more informed trading decisions.

Beyond the Charts: The Human Element

While order flow analysis provides a powerful set of analytical tools, it’s essential to remember that the market is ultimately driven by human emotions and psychology. Successful order flow traders understand that market trends are shaped by a complex interplay of factors, including news events, economic data, and the collective sentiment of market participants. Recognizing this human element enhances the ability to interpret order flow data and make informed trading decisions.

Latest Trends and Developments in Order Flow Trading

The world of order flow trading is constantly evolving, with new tools, techniques, and strategies emerging. One exciting trend is the increasing integration of artificial intelligence (AI) and machine learning (ML) into order flow analysis. AI algorithms can process vast amounts of order flow data, identifying complex patterns and anomalies that may be missed by human analysts. This advancement is paving the way for more sophisticated and potentially more accurate trading strategies.

Another key development is the emergence of specialized order flow platforms. These platforms offer real-time order book data, sophisticated analytics, and visualization tools, empowering traders with the necessary resources to harness the power of order flow analysis.

Expert Tips for Order Flow Trading Success

My journey into order flow trading has taught me valuable lessons, leading me to develop a set of tips that I believe can contribute to your success:

- Understand the context: Don’t approach order flow analysis in isolation. Consider the bigger picture, including economic data, news events, and market sentiment.

- Focus on high-liquidity markets: Order flow analysis works best in markets with high trading volume, providing a statistically significant sample of order flow data.

- Practice, practice, practice: Mastering order flow analysis takes time and dedication. Start with simulation trading and gradually build your experience before risking real capital.

- Develop your trading plan: Define clear entry and exit points, manage your risk effectively, and stick to your trading plan.

- Stay humble: The market can be unpredictable, and even the best order flow analysis cannot guarantee success. Stay humble, be prepared for unexpected turns, and manage your emotions effectively.

FAQ on Order Flow Trading

What are the benefits of order flow trading?

Order flow trading can provide a significant edge in the market by revealing hidden market information, identifying potential trends, and potentially increasing trading accuracy and profitability.

Is order flow trading suitable for all traders?

Order flow trading requires a certain level of technical expertise and market knowledge. It may not be suitable for beginner traders.

What are the risks associated with order flow trading?

As with any trading strategy, there are inherent risks involved. Order flow analysis is not foolproof, and market conditions can be unpredictable. Proper risk management and careful planning are essential.

What resources are available for learning about order flow trading?

Numerous online resources, including blogs, books, courses, and trading communities, provide information and education on order flow trading.

Order Flow Trading For Fun And Profit

https://youtube.com/watch?v=6f30MZhijOI

Conclusion

Order flow trading offers a unique and powerful approach to understanding the dynamics of financial markets. By unlocking the secrets hidden within the flow of buy and sell orders, traders can gain a distinct advantage, potentially improving their trading performance. The journey into the world of order flow trading is an exciting one, filled with opportunities for learning, growth, and potentially, significant profit. Are you ready to embark on this journey and discover the secrets of the market?