My first foray into entrepreneurship was a disastrous attempt at selling homemade cookies at the local farmer’s market. I poured my heart and soul into those cookies, dreaming of a bustling stand and a profitable venture. But reality struck when I realized that despite selling a good quantity, I barely broke even. I had underestimated expenses like market fees, packaging, and ingredient costs. It was a harsh lesson, but it taught me the importance of understanding the break-even point. This crucial metric can make the difference between a thriving business and a financial drain.

Image: www.studypool.com

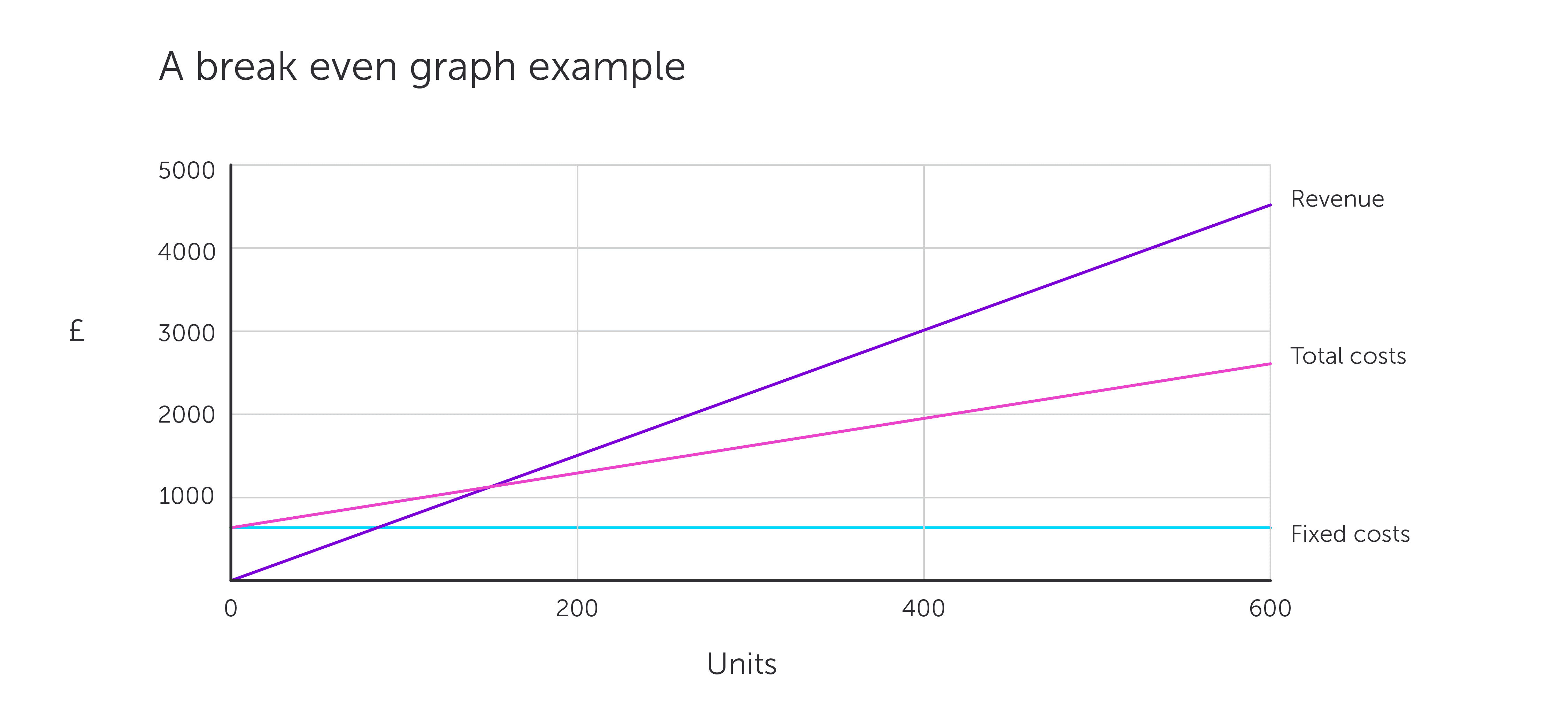

In the world of business, the break-even point acts as a critical compass, guiding us toward profitability. It’s the moment when your revenue precisely covers your expenses, signifying the point where you start turning a profit. Determining your break-even point may seem like a simple calculation, but it offers valuable insight into the financial health of your business, allowing you to make informed decisions for growth and success.

Understanding the Break-Even Point: A Foundation for Success

The break-even point is the level of sales a business needs to achieve to cover all its fixed and variable costs. It signifies the point where the business is neither making a profit nor incurring a loss. Think of it as the starting line in a race toward profitability.

To calculate the break-even point, you need to understand the difference between fixed costs and variable costs. Fixed costs remain relatively stable regardless of production or sales volume. Examples include rent, salaries, and insurance premiums. Variable costs fluctuate based on the volume of goods or services produced. Think of raw materials, direct labor, and shipping costs.

Calculating the Break-Even Point: A Step-by-Step Process

The break-even point can be calculated using a simple formula:

Break-Even Point = Fixed Costs / (Selling Price Per Unit – Variable Cost Per Unit)

Let’s break down this formula with an example.

Imagine you run a small bakery that specializes in artisan sourdough bread. Your fixed costs, including rent, utilities, and equipment, amount to $2,000 per month. The cost of ingredients and labor to produce one loaf of bread is $3 (variable cost). You sell each loaf for $7 (selling price).

Here’s how you would calculate your break-even point:

Break-Even Point = $2,000 / ($7 – $3) = 500 loaves

This means you need to sell 500 loaves of bread each month to cover all your expenses and break even. Any sales beyond this point contribute directly to your profits.

Break-Even Point Example Questions and Answers

Let’s address some common questions that arise when working with the break-even point:

Q: What if my fixed costs change?

A: Changes in fixed costs will directly impact your break-even point. If fixed costs rise, you’ll need to sell more products to reach the break-even point. Conversely, a decrease in fixed costs will lower your break-even point.

Image: www.simplybusiness.co.uk

Q: How can I lower my break-even point?

A: You can lower your break-even point by:

- Reducing fixed costs: Negotiate better rent rates, streamline operations, or explore cost-effective alternatives for equipment or supplies.

- Raising selling prices: Carefully evaluate your pricing strategy and explore the possibility of increasing selling prices without impacting demand.

- Lowering your variable costs: Find less expensive raw materials, optimize production processes, or negotiate better prices with suppliers.

Q: What if my market demand fluctuates?

A: Understanding your break-even point can be crucial in managing fluctuations in demand. If you anticipate a drop in sales, you might consider implementing strategies like cost reduction or altering your product mix to minimize losses. Conversely, you can prepare for periods of high demand by maximizing production and ensuring adequate inventory or staffing.

Q: How can the break-even point help me make informed business decisions?

A: The break-even point provides valuable insights for strategic decision-making, including:

- Setting pricing: By understanding the break-even point, you can determine a profitable selling price for your products or services.

- Product development: The break-even point helps evaluate the profitability potential of new product launches or product line expansions.

- Cost control: Monitoring the break-even point empowers you to identify areas for cost reduction and optimize efficiency.

- Investment decisions: The break-even point can help determine the feasibility of new investments or expansion plans, ensuring you have a clear runway to profitability.

Utilizing the Break-Even Point for Business Growth

The break-even point is not just a theoretical concept. It’s a dynamic tool that can be strategically utilized for business growth. By understanding your break-even point, you can:

Set realistic targets: Instead of aiming for arbitrary sales figures, focus on exceeding your break-even point to ensure consistent profitability.

Optimize resource allocation: With a clear understanding of your break-even point, you can allocate resources effectively, prioritizing areas that contribute most to profitability.

Make informed decisions about pricing: The break-even point informs the minimum price you need to charge to cover your costs. Carefully consider your pricing strategy to balance profitability and market demand.

Frequently Asked Questions (FAQs)

Q: What is the difference between break-even analysis and profitability analysis?

A: Break-even analysis focuses on the point at which a business covers its costs, while profitability analysis goes beyond break-even, examining the potential for profit generation. The break-even point helps determine the level of sales needed to start earning a profit, while profitability analysis assesses the overall financial performance and profit margins.

Q: Can the break-even point be used for non-profit organizations?

A: Yes, the break-even point concept can be applied to non-profit organizations, though it’s not necessarily about “profit.” Non-profits use the break-even point to determine the revenue required to cover their operational costs. This information can help them plan fundraising activities, allocate resources effectively, and achieve their mission-driven goals.

Q: What is margin of safety, and how does it relate to the break-even point?

A: Margin of safety is the difference between your actual sales and your break-even sales. It represents the buffer you have to cover unexpected expenses or dips in sales. A higher margin of safety indicates a more financially stable business position.

Break Even Point Example Questions And Answers

The Power of Understanding

Understanding your break-even point is an essential step towards building a successful and sustainable business. By incorporating it into your decision-making process, you can make informed choices about pricing, cost management, and growth strategies. Remember, the break-even point is not just a number; it’s a roadmap to profitability.

Are you ready to take control of your business’s financial health?