Imagine this: You wake up one morning and discover a secret stash of gold coins hidden beneath your bed. It’s a treasure trove, a windfall of wealth that could change your life. But what if that gold wasn’t yours? What if it belonged to your entire nation, a collective savings amassed over generations? That’s the essence of “savings by nation,” an intriguing concept that sheds light on the financial well-being of entire countries.

Image: www.chegg.com

Understanding “savings by nation” goes beyond just a number. It reveals a nation’s resilience, its capacity to navigate economic storms, and its ability to invest in its future. In this article, we’ll delve into the intricacies of savings by nation, uncovering the secrets of Chapter 3, Lesson 1 – a critical chapter in the story of global finance.

Unveiling Chapter 3, Lesson 1: The Fundamentals

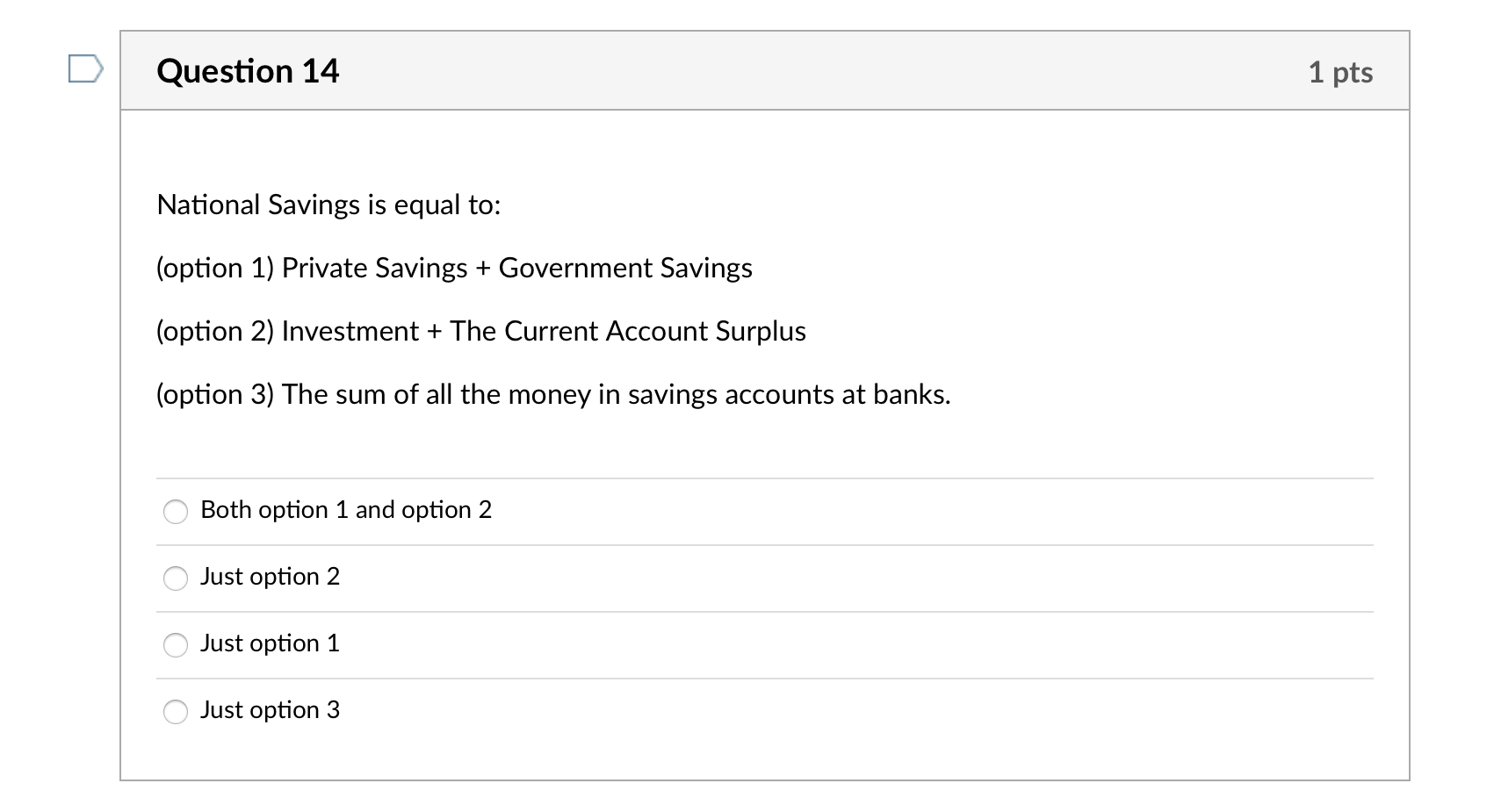

Chapter 3, Lesson 1, often referred to as the “savings” chapter in economics textbooks, delves into the crucial role of savings in a nation’s economic health. It’s not just about individual households putting aside money. It’s about the collective savings of a nation, encompassing the funds held by individuals, businesses, and the government.

Think of it like a collective piggy bank for a nation. When a country saves, it’s setting aside resources for future investments. These investments can fuel economic growth, create jobs, and improve living standards. A nation’s savings rate often reflects its economic maturity and its people’s confidence in the future.

Factors Driving Savings by Nation

Several factors influence the savings rate of a nation, painting a complex picture of economic dynamics:

1. Cultural and Historical Influences: Culture plays a significant role in savings patterns. In some cultures, saving is ingrained in the fabric of society, emphasizing long-term financial security and resilience. Historical events can also shape saving behavior, leading to higher savings rates in countries that have experienced economic hardships or political instability.

2. Economic Growth and Income: A nation’s level of economic growth and income distribution can significantly impact its saving rate. As economies flourish, individuals are more likely to save, often driven by aspirations for a better future, education, or healthcare.

3. Government Policies: Governments can influence savings rates through various policies, such as tax incentives, retirement savings programs, and interest rate adjustments. Fiscal policies aimed at promoting savings and investment can foster a culture of collective financial responsibility.

4. Investment Opportunities: The availability and attractiveness of investment opportunities also influence saving patterns. If a nation offers attractive investment avenues, its citizens might be more inclined to save, knowing their savings can fuel economic growth and benefit their future.

5. Consumer Confidence: Consumer confidence plays a crucial role. When citizens are pessimistic about the future, they might be more likely to save, fearing economic uncertainty. Conversely, positive economic sentiment can lead to increased spending and lower savings rates.

A Global Perspective on Savings by Nation

The world stage presents a kaleidoscope of savings patterns. Developed nations generally boast higher savings rates than developing countries. However, this isn’t always the case. Factors like cultural norms, economic development, and political stability can significantly influence a nation’s savings rate:

1. Asian Savings Powerhouses: Nations like Japan, South Korea, and Singapore are renowned for their high savings rates, often attributed to cultural values that emphasize long-term financial planning and security. These savings have played a pivotal role in their economic growth and development.

2. The European Savings Landscape: European nations often exhibit moderate to high savings rates, driven by factors like social security programs and a strong tradition of financial planning.

3. The United States: A Paradoxical Case: The United States, a global economic powerhouse, has historically shown relatively lower savings rates compared to other developed nations. This is partly attributed to factors like a consumer-driven economy, a high level of consumer confidence, and a relatively low national debt burden.

Image: www.lessonplanet.com

The Impact of Savings by Nation: A Global Ripple Effect

A nation’s savings have far-reaching consequences, not just for its own economy but for the global financial landscape.

1. Fueling Economic Growth: Savings serve as the engine of investment. When a nation saves, it can invest in infrastructure, education, healthcare, and technology, propelling economic growth and creating jobs.

2. Reducing National Debt: High savings rates can help reduce national debt. When governments spend less than they collect in taxes, they can use the surplus to pay down debt, reducing future interest payments and freeing up funds for other priorities.

3. Enhancing Financial Stability: Strong national savings offer a buffer against economic shocks. During recessions or crises, nations with substantial savings can draw on their reserves to mitigate adverse effects and support their economies.

4. Global Investment Opportunities: High national savings often translate into increased investment abroad, contributing to global capital flows and fostering economic development in other countries.

Unlocking the Potential of Saving by Nation

Understanding the concept of savings by nation empowers individuals, businesses, and governments alike. Here’s how we can leverage this knowledge:

1. Individuals:

- Embrace a savings mindset: Prioritizing savings, even in small amounts, can create a foundation for financial security.

- Explore long-term savings vehicles: Utilize retirement funds, investment accounts, and other savings instruments to maximize growth over time.

2. Businesses:

- Invest in Innovation: Savings can fuel research, development, and innovation, driving business growth and creating jobs.

- Promote Employee Financial Well-being: Supporting employees’ financial goals through savings programs and financial literacy initiatives can enhance their well-being and loyalty.

3. Governments:

- Create policies conducive to savings: Tax incentives, retirement savings programs, and financial education initiatives can encourage higher savings rates.

- Invest in long-term growth: Governments can use savings to invest in infrastructure, education, and research, laying the groundwork for sustainable economic growth.

Savings By Nation Chapter 3 Lesson 1

Saving for the Future: A Collective Responsibility

Saving by nation is not just a financial concept; it’s a shared responsibility that impacts generations to come. By understanding the dynamics of savings, we can make informed decisions, advocate for policies that promote financial well-being, and contribute to a brighter economic future for ourselves and our planet.

The journey of savings by nation is a fascinating story, one that continuously unfolds with the ebb and flow of global economics. Chapter 3, Lesson 1, is just the beginning. By learning and embracing the principles of savings, we can not only secure our individual futures but also contribute to the collective prosperity of our nations and the world.