The screech of brakes, the jarring impact, and the chaos that follows – a car accident can be a traumatic experience. And if you find yourself injured and facing medical bills, dealing with insurance companies can add another layer of stress. When it comes to negotiating a settlement, having a clear and legally sound agreement is crucial. This is where a private settlement car accident payment agreement letter comes into play.

Image: tutore.org

Imagine this: You’ve been involved in a car accident, and the other driver’s insurance company offers you a settlement. While relieved to have some financial assistance, you’re unsure if it’s enough to cover your expenses. This is when a carefully crafted letter outlining terms and details becomes your safety net – ensuring both parties are clear on what’s agreed upon.

Understanding Private Settlement Agreements: Your Rights and Obligations

A private settlement agreement is a legally binding contract between you and the at-fault party or their insurance company. It outlines the terms of resolving a car accident claim without going through a court trial. This agreement should clearly specify the amount of money you’ll receive, what it covers, and what you’re giving up in return.

It’s crucial to note that private settlements are not always the best option. Depending on the severity of your injuries, the complexity of the case, and the strength of your evidence, consulting with a personal injury attorney may be beneficial. An experienced lawyer can help you assess the fairness of any offer and negotiate a better outcome.

Key Benefits of a Private Settlement:

- Faster Resolution: Private settlements can be quicker than going through a lengthy legal process.

- Greater Control: You have more control over the settlement details and terms.

- Potential for a Higher Payment: In some cases, private settlements may result in a higher payout than what you might receive in court.

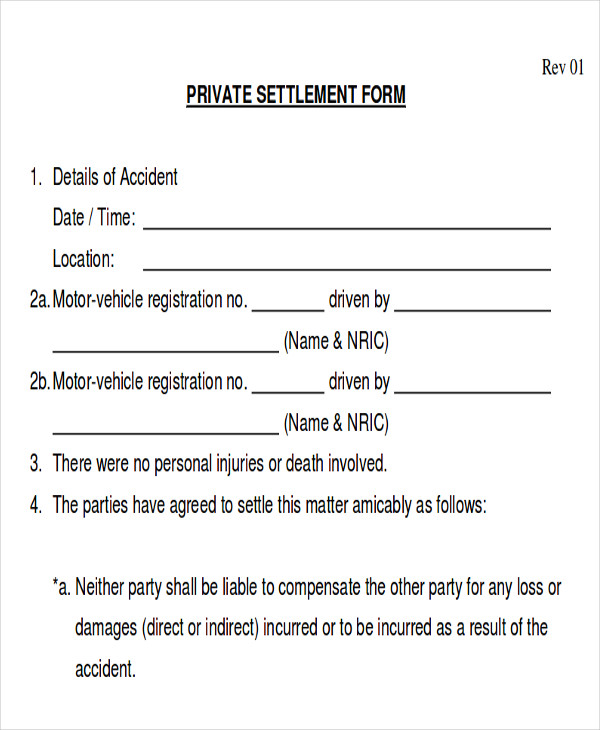

Essential Components of a Private Settlement Agreement:

A comprehensive private settlement agreement should cover various aspects:

- Parties Involved: The names and contact information of all parties involved.

- Accident Details: A detailed description of the accident, including the date, location, and involved vehicles.

- Damages: A complete list of all damages, including medical expenses, lost wages, property damage, and pain and suffering.

- Settlement Amount: The total amount of the settlement and how it will be paid. This could be a lump sum or structured payments over time.

- Release of Claims: You must clearly state that you are releasing all claims against the at-fault party and their insurance company.

- Confidentiality: If desired, you can include a confidentiality clause to prevent the details of the settlement from being disclosed.

- Signatures and Dates: All parties should sign and date the agreement to signify their consent.

Image: alvera-mezquita.blogspot.com

Sample Private Settlement Agreement Letter

Here is a sample letter outlining a private settlement agreement. This is not a legal document and should be reviewed by an attorney for your specific situation.

Sample Letter:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Insurance Company Name]

[Insurance Company Address]

Re: Private Settlement Agreement for Car Accident on [Date of Accident]

Dear [Insurance Company Representative Name],

This letter serves as a formal agreement for the private settlement of my car accident claim stemming from the collision that occurred on [Date of Accident] at [Location of Accident]. This agreement is made between myself, [Your Name], and [Insurance Company Name], representing the at-fault party, [Name of At-Fault Party].

In consideration of the payment of [Settlement Amount], I, [Your Name], agree to release all claims against [Insurance Company Name] and [Name of At-Fault Party] related to the accident, including any and all claims for personal injuries, property damage, lost wages, pain and suffering, and any other damages arising from the accident. This settlement is in full and final settlement of all such claims.

This settlement includes the following specific elements:

- Payment of [Medical Expenses Amount] for medical bills already incurred and any future medical treatment related to the accident.

- Payment of [Lost Wages Amount] for lost income due to the accident.

- Payment of [Property Damage Amount] for damage to my vehicle.

- Payment of [Pain and Suffering Amount] for the pain, suffering, and emotional distress caused by the accident.

Should you fail to fulfill any of the terms outlined above within [Time Frame], I reserve the right to pursue any legal action necessary to enforce this agreement. This agreement is subject to the laws of the state of [State].

Please sign and return a copy of this letter confirming your acceptance of this agreement. Once received, I will sign and return a copy to you.

Sincerely,

[Your Name]

[Signature]

This sample letter is a starting point. It’s essential to customize it according to your specific circumstances, including the details of your injuries, damages, and any other relevant information.

Negotiating a Private Settlement: Tips and Strategies

Navigating the negotiation process for a private settlement can be challenging, but by keeping these tips in mind, you can improve your chances of getting a fair and favorable outcome.

1. Gather Evidence:

Before you negotiate, gather all the evidence you can, including photographs of the accident scene, medical records, repair bills, and wage loss documentation. This evidence will support your claims and help you determine a reasonable settlement amount.

2. Understand Your Legal Rights:

It’s crucial to be informed about your legal rights under your state’s car accident laws. Learn about the statute of limitations for filing claims, how insurance companies handle accident claims, and what type of compensation you are legally entitled to.

3. Don’t Settle Too Quickly:

Insurance companies often try to settle quickly and for a lower amount. Don’t rush into an agreement until you have carefully considered all your options. Give yourself time to assess the offer, consult with a legal professional if necessary, and understand the potential ramifications of signing a settlement.

4. Be Prepared to Negotiate:

Negotiations require patience and assertiveness. Be prepared to back up your claims with evidence and don’t be afraid to ask for what you deserve. Remember, the insurance company is looking out for their own interests, so you need to advocate for yourself.

5. Seek Legal Counsel:

If you are unsure about the negotiation process, or if the case is complex or involves significant injuries, it’s highly recommended to consult with a personal injury attorney. An attorney can provide legal advice, negotiate on your behalf, and represent your interests during the settlement process.

Common FAQs:

1. Can I negotiate with the insurance company after signing a settlement agreement?

Once you sign a settlement agreement, it becomes legally binding. This means that you can’t typically renegotiate the terms. However, there may be exceptions depending on the specific terms of the agreement and the applicable state laws. It’s highly advisable to consult with a legal professional if you have any doubts or concerns about a settlement agreement.

2. What happens if I don’t agree with the offered settlement?

If you don’t agree with the settlement offer, you can either counteroffer with your desired amount or pursue legal action by filing a lawsuit in court. However, pursuing legal action can be protracted and expensive, so it’s essential to weigh the costs and benefits carefully before deciding.

3. Can I still pursue legal action after reaching a settlement agreement?

In most cases, signing a settlement agreement will release you from any further legal claims related to the accident. However, there might be situations where you still have legal options, such as if the agreement was obtained fraudulently or if you later discover additional injuries resulting from the accident. Again, consulting with an attorney is highly recommended to understand your specific legal situation.

Private Settlement Car Accident Payment Agreement Letter Sample

Conclusion:

A private settlement agreement can help streamline the process of resolving your car accident claim. A well-crafted agreement protects your rights and ensures everyone understands the terms and obligations involved. Remember, it’s crucial to be informed and prepared to negotiate, and seeking professional legal advice can provide valuable insights and improve your negotiating position.

If you have any questions or need further clarification, don’t hesitate to leave a comment below. We’re here to help you navigate the complexities of car accident settlements and protect your interests.

Are you interested in learning more about how to navigate the legal aspects of car accident settlements? We encourage you to share your thoughts and questions in the comments section below. Your insights and experiences can help others who are facing similar situations.