Have you ever wondered how businesses keep track of their money? Maybe you’ve even tried to decipher a balance sheet, only to be met with a confusing jumble of numbers and unfamiliar terms. Accounting Chapter 3 is often the first step into the fascinating world of financial reporting, laying the foundation for understanding how businesses manage their assets and liabilities. But navigating the concepts and terminology can be daunting. In this comprehensive guide, we’ll break down Chapter 3’s key principles, explore real-world applications, and equip you with the knowledge necessary to ace your test – and ultimately grasp the fundamentals of financial accounting.

Image: classlibsybil.z21.web.core.windows.net

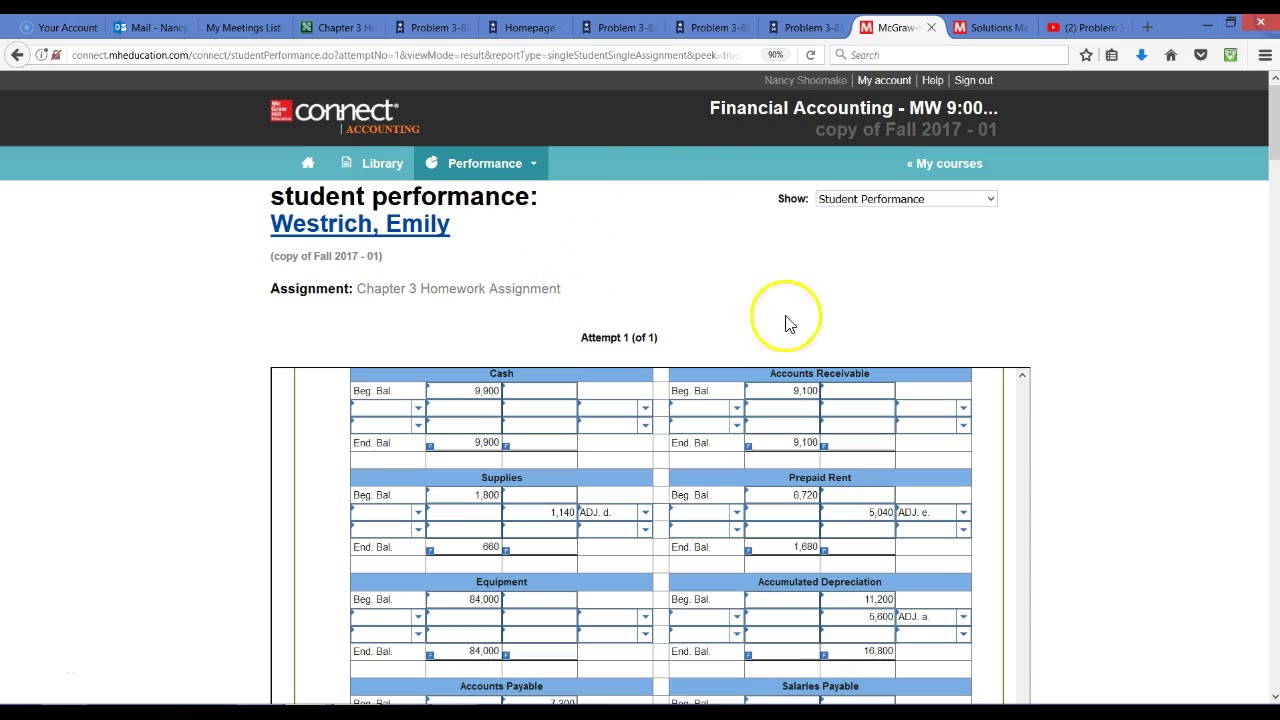

Chapter 3 typically focuses on the accounting equation, which serves as the core principle of double-entry bookkeeping. It’s a simple but powerful formula that states that a company’s assets always equal the sum of its liabilities and equity. This equation acts as a balancing act, ensuring that every transaction is recorded accurately and that the financial picture remains consistent. By mastering this equation, you’ll unlock a deeper understanding of how businesses track their financial performance and make informed decisions.

Understanding the Accounting Equation: The Linchpin of Financial Reporting

The Basics

Think of the accounting equation as a seesaw, perfectly balanced. On one side, it represents what a company **owns** (its assets). These are resources such as cash, inventory, equipment, and even intangible assets like trademarks or patents. On the other side, we have what the company **owes** (its liabilities) and the owner’s stake in the business (its equity). Liabilities are obligations, like loans or accounts payable, while equity represents the owner’s investment and profits.

The Equation: Assets = Liabilities + Equity

This equation is fundamental to every accounting transaction. Every time a business makes a sale, purchases inventory, pays a bill, or invests more money, the accounting equation needs to be balanced to reflect the change. Let’s break down each component:

- Assets: Resources controlled by the company that have potential future economic benefits. They are classified as either current (short-term) or non-current (long-term), depending on how quickly they can be converted to cash.

- Liabilities: Obligations to pay money or provide services to others in the future. Liabilities are also categorized as current or non-current, based on the time frame for their payment.

- Equity: The owners’ stake in the company. It represents the accumulated profits, minus any losses, minus any owner withdrawals. Equity is a crucial measurement of the company’s value and owner’s financial position.

Image: www.studocu.com

Illustrative Examples: Bringing the Accounting Equation to Life

Scenario 1: A New Business Venture

Imagine a young entrepreneur starting a flower shop. They invest $10,000 of their own money to buy inventory, supplies, and a display case. This investment increases the business’s assets (inventory, supplies, display case) by $10,000. Simultaneously, the equity (owner’s investment) also increases by $10,000. The equation remains balanced: $10,000 (assets) = $0 (liabilities) + $10,000 (equity).

Scenario 2: Taking Out a Loan

Now our florist needs more space and decides to take out a $20,000 bank loan to rent a bigger storefront. This increases the company’s assets by $20,000 (cash from the loan) but also increases its liabilities by $20,000 (the loan). The equation holds true: $30,000 (assets) = $20,000 (liabilities) + $10,000 (equity).

Scenario 3: Making a Sale

The florist sells a bouquet for $50. This increases the company’s assets (cash) by $50 and also increases equity (profit from the sale) by $50. The equation remains balanced: $30,050 (assets) = $20,000 (liabilities) + $10,050 (equity).

Beyond the Basic Equation: Examining Essential Accounting Concepts

The Balance Sheet

The accounting equation is the core of the **balance sheet**, a fundamental financial statement that summarizes a company’s assets, liabilities, and equity at a specific point in time. This snapshot provides insights into a company’s financial health, its ability to meet its obligations, and the owner’s net worth.

Transactions and Double-Entry Bookkeeping

Every business activity, from a simple purchase to a complex loan agreement, necessitates a transaction. The essence of accounting is to record these transactions accurately, ensuring that the accounting equation always remains in balance. This is achieved through **double-entry bookkeeping**, a system where every transaction affects at least two accounts, ensuring that the equation stays balanced. For example, if a company buys inventory, the cash account decreases (asset), and the inventory account increases (asset). The equation remains balanced as one asset decreases, and another asset increases simultaneously.

Debits and Credits: Understanding the Language of Accounting

In double-entry bookkeeping, transactions are recorded using **debits and credits**. Debits increase asset and expense accounts, while they decrease liability, equity, and revenue accounts. Credits do the opposite: they increase liability, equity, and revenue accounts while decreasing asset and expense accounts. Mastering the concept of debits and credits is essential to understanding the flow of money through a business and interpreting financial statements.

The Significance of Chapter 3: Building a Solid Foundation

Chapter 3 is the bedrock of accounting, introducing essential concepts and principles that underpin financial reporting. By mastering these fundamentals, you will gain valuable insights into:

- How businesses track their financial position

- The relationship between assets, liabilities, and equity

- The importance of accurate financial reporting

- The practical implications of financial information for decision-making

Tips for Success: Mastering Chapter 3

Here are a few strategies to help you gain a strong understanding of Chapter 3:

- Practice, practice, practice: The best way to solidify your understanding of the accounting equation is to practice applying it to different scenarios. Use example problems and create your own scenarios to test your grasp of the concept.

- Connect the concepts: Don’t treat debits, credits, and the accounting equation as separate ideas. Understand how these principles work together to create a cohesive financial picture of a business.

- Seek out real-world examples: Look beyond textbook scenarios. Explore financial statements of publicly-traded companies to see the accounting equation in action. Analyze trends, understand the relationships between different accounts, and observe how financial information is used to make decisions.

- Don’t be afraid to ask for help: If you’re struggling with a concept, don’t hesitate to seek clarification from your teacher or classmates.

Accounting Chapter 3 Test A Answers

The Bottom Line: Accounting Chapter 3 Provides a Powerful Foundation

Chapter 3 of your accounting text might seem daunting at first, but it holds the key to understanding the core principles of financial reporting. By applying the accounting equation, practicing double-entry bookkeeping, and exploring real-world examples, you will gain a solid foundation for your journey in accounting and finance. Remember, accounting is more than just a set of rules; it is a language that enables businesses to communicate their financial performance and make informed decisions. So, embrace the challenge, master the concepts, and embark on your journey to becoming an accounting expert!