Have you ever wondered how you can efficiently manage your Bank of America accounts, especially when it comes to transactions that require specific instructions? The answer lies in a powerful tool – the Bank of America Letter of Instruction PDF. This document acts as a bridge between you and your financial institution, allowing you to provide detailed instructions for various banking tasks, ensuring accuracy and eliminating potential misunderstandings.

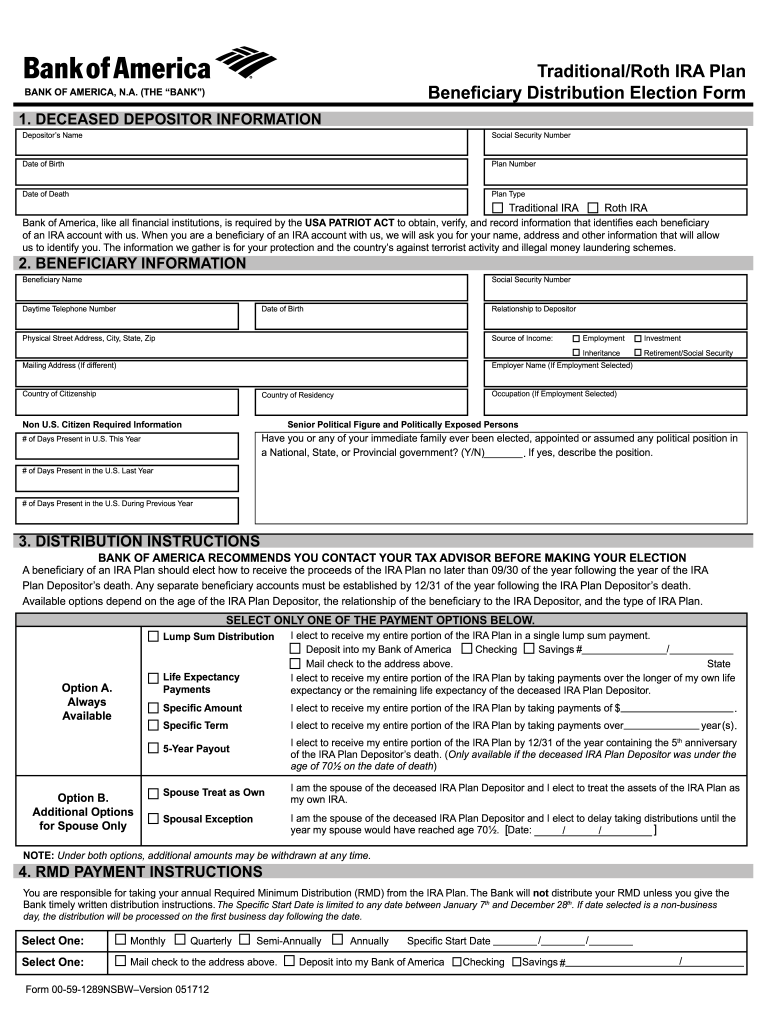

Image: www.dochub.com

A Bank of America Letter of Instruction PDF is essentially a written document outlining your specific instructions for a particular financial process, such as wire transfers, account transfers, or even the distribution of assets upon your passing. It’s a vital tool for ensuring your financial wishes are carried out precisely and securely, leaving no room for ambiguity or error.

Understanding the Power of a Letter of Instruction

Imagine needing to move a large sum of money between accounts or initiating a complex international transaction. In such scenarios, a simple phone call or online banking interaction might not be sufficient. Here’s where the Letter of Instruction shines. By providing a detailed written record, you can eliminate any doubt about your intentions and ensure the transaction is handled exactly as you desire.

Beyond simply facilitating transactions, Letter of Instructions can play a crucial role in ensuring your financial legacy is preserved. By creating a Letter of Instruction detailing the distribution of your assets, you can ensure your wishes are respected even after you’re gone. This document becomes a legal framework for your beneficiaries and executors, guiding them through the process of managing your estate and honoring your final wishes.

Types of Bank of America Letters of Instruction

Bank of America offers Letter of Instructions for a variety of purposes, each tailored to meet specific needs. Some common types include:

1. Wire Transfer Letter of Instruction

This type of Letter of Instruction is essential for initiating domestic or international wire transfers. It provides detailed information about the sender, the recipient, the amount to be transferred, and any specific instructions for the transaction. This level of detail helps ensure that the funds are transferred securely and accurately.

Image: fixdbkrause.z19.web.core.windows.net

2. Account Transfer Letter of Instruction

If you wish to transfer funds between your different Bank of America accounts, a dedicated Letter of Instruction can assist you. This document clearly outlines the originating account, the destination account, and the amount to be transferred. It also helps eliminate potential errors and ensures seamless fund movement between your accounts.

3. Estate Planning Letter of Instruction

This type of Letter of Instruction is crucial for individuals planning their estate. It outlines how your assets should be distributed upon your passing. It can include details about beneficiaries, executors, specific instructions for asset distribution, and other relevant information. This document clarifies your wishes and helps your executors understand and fulfill your financial legacy.

How to Create a Bank of America Letter of Instruction

Creating a Bank of America Letter of Instruction is a straightforward process. Here are the key steps:

1. Access the Letter of Instruction Template

Visit the Bank of America website and navigate to the “Letters of Instruction” or “Account Services” section. Look for downloadable templates or forms that cater to your specific needs.

2. Fill in the Required Information

Carefully read the instructions provided with the template and accurately fill in the necessary details. This may include your personal information, account numbers, beneficiary information, and specific instructions for the transaction or account management. Be sure to use clear and concise language, avoiding any ambiguity or room for interpretation.

3. Review and Sign the Document

Once you have completed the form, carefully review all the information to ensure accuracy. Make any necessary corrections. Sign the document in the designated space, and date it to finalize your Letter of Instruction.

4. Submit the Letter of Instruction

Depending on the type of Letter of Instruction, you may be able to submit it online, fax it, or mail it to Bank of America. Review the instructions provided on the form or website to understand the appropriate submission method.

Benefits of Using a Bank of America Letter of Instruction

There are numerous advantages to using a Bank of America Letter of Instruction, including:

1. Improved Accuracy

By providing comprehensive instructions in a written format, you greatly reduce the risk of errors or misinterpretations. This ensures that your financial transactions and wishes are carried out precisely as you intended.

2. Enhanced Security

A Letter of Instruction acts as a secure record of your instructions. It minimizes the chances of unauthorized transactions or fraud, as all actions must be performed according to the documented instructions.

3. Peace of Mind

Knowing that your financial matters are handled according to your plan provides peace of mind. You can rest assured that your assets will be managed efficiently, and your wishes will be honored, even in your absence.

4. Streamlined Estate Planning

A Letter of Instruction can significantly simplify estate planning by clearly outlining your intentions regarding the distribution of assets. It helps your beneficiaries and executors navigate the estate settlement process with ease and clarity.

Tips for Creating Effective Letters of Instruction

To ensure your Letters of Instruction are clear, concise, and effective, consider these tips:

- Use Clear and Concise Language: Avoid jargon or overly complex vocabulary. Ensure your instructions are easily understood.

- Be Specific: Provide detailed information about your desired outcome. Avoid vague statements or assumptions.

- Include All Relevant Details: Include your account information, beneficiary details, contact information, and any other relevant information needed for the transaction or process.

- Sign and Date the Document: A signature and date add legitimacy to your Letter of Instruction.

- Retain Copies: Always keep a copy of your Letter of Instruction for your records.

Bank Of America Letter Of Instruction Pdf

https://youtube.com/watch?v=k55NEqogzgU

Conclusion

Bank of America Letter of Instruction PDFs are powerful tools that can significantly enhance your control over your finances. They ensure accuracy, security, and peace of mind for both simple and complex financial transactions. Take advantage of these documents to streamline your banking operations, manage your estate effectively, and ensure your financial wishes are always respected. Remember to review your Letters of Instruction regularly, especially after significant life changes, to ensure they reflect your current financial objectives.