Have you ever stared at your pay stub, bewildered by the cryptic numbers and confusing abbreviations? You’re not alone. Many of us feel lost in the labyrinth of deductions, taxes, and seemingly endless categories. But what if I told you that understanding your pay stub isn’t just about knowing how much money you’re taking home; it’s about gaining control of your finances and securing a brighter financial future?

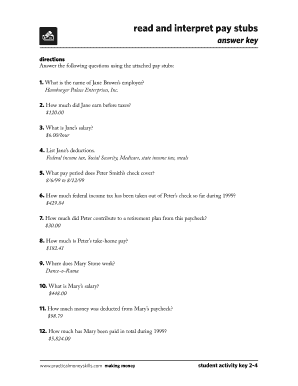

Image: www.signnow.com

This guide is inspired by the financial wisdom of Dave Ramsey, a renowned personal finance expert who emphasizes the importance of understanding your money. We’ll explore the key elements of a pay stub, decode its hidden messages, and empower you to utilize this information to make smarter financial decisions.

Decoding the Mysteries of Your Pay Stub

Imagine a pay stub as a map leading you through the financial journey of your earnings. It’s a detailed document that provides a snapshot of your income, taxes, and deductions. To navigate this map effectively, let’s break it down into its essential components:

1. Gross Earnings: This is the total amount of money you’ve earned before any deductions. Think of it as the raw material before it’s been shaped into your take-home pay.

2. Deductions & Taxes: These are the various amounts deducted from your gross earnings. The most common deductions include:

- Federal Income Tax: This is the largest chunk of taxes paid to the federal government. It supports essential services like infrastructure, healthcare, and national security.

- State Income Tax: Depending on where you live, you may also be subject to state income tax.

- Social Security & Medicare: These mandatory deductions fund social security benefits for retirees and Medicare healthcare coverage for the elderly and disabled.

- Health Insurance: If your employer offers health insurance, premiums may be deducted from your pay.

- Retirement Savings: Contributions to 401(k) plans or other employer-sponsored retirement accounts.

- Other Deductions: This category can include various deductions like union dues, charitable donations, or contributions to flexible spending accounts.

3. Net Pay (Take-Home Pay): This is the amount of money you actually receive after all deductions. It’s the money you have available to spend, save, or invest.

Unveiling The Ramsey Approach to Pay Stub Analysis

Dave Ramsey’s philosophy towards pay stubs centers on taking ownership of your finances and understanding how your money is distributed. He encourages a proactive approach, urging individuals to analyze their pay stubs with a critical eye. He suggests asking yourself these questions:

- Where’s my money going? Looking closely at the detailed breakdown of deductions can reveal areas where you may be able to optimize your finances.

- Is there room for improvement? By analyzing your deductions, you can identify potential areas to reduce or eliminate unnecessary expenses.

- Am I adequately saving for retirement? Pay stubs provide a snapshot of your retirement contributions, allowing you to track your savings progress and ensure you’re on track for a comfortable future.

The Power of Pay Stub Awareness

Understanding your pay stub isn’t just about knowing how much money you have left after deductions; it’s about empowering yourself to make informed financial decisions. Here’s how it can benefit you:

- Budgeting with Accuracy: With a solid understanding of your income and deductions, you can create a realistic budget that aligns with your financial goals.

- Debt Management: Analyzing your pay stub can help you identify potential areas to reduce unnecessary expenses, freeing up cash flow to tackle debt.

- Retirement Planning: Tracking your retirement contributions on your pay stubs enables you to assess your progress and adjust your savings strategy as needed.

- Negotiating Compensation: Armed with information about your pay stub, you can approach salary negotiations with confidence, knowing your worth and the impact of potential increments.

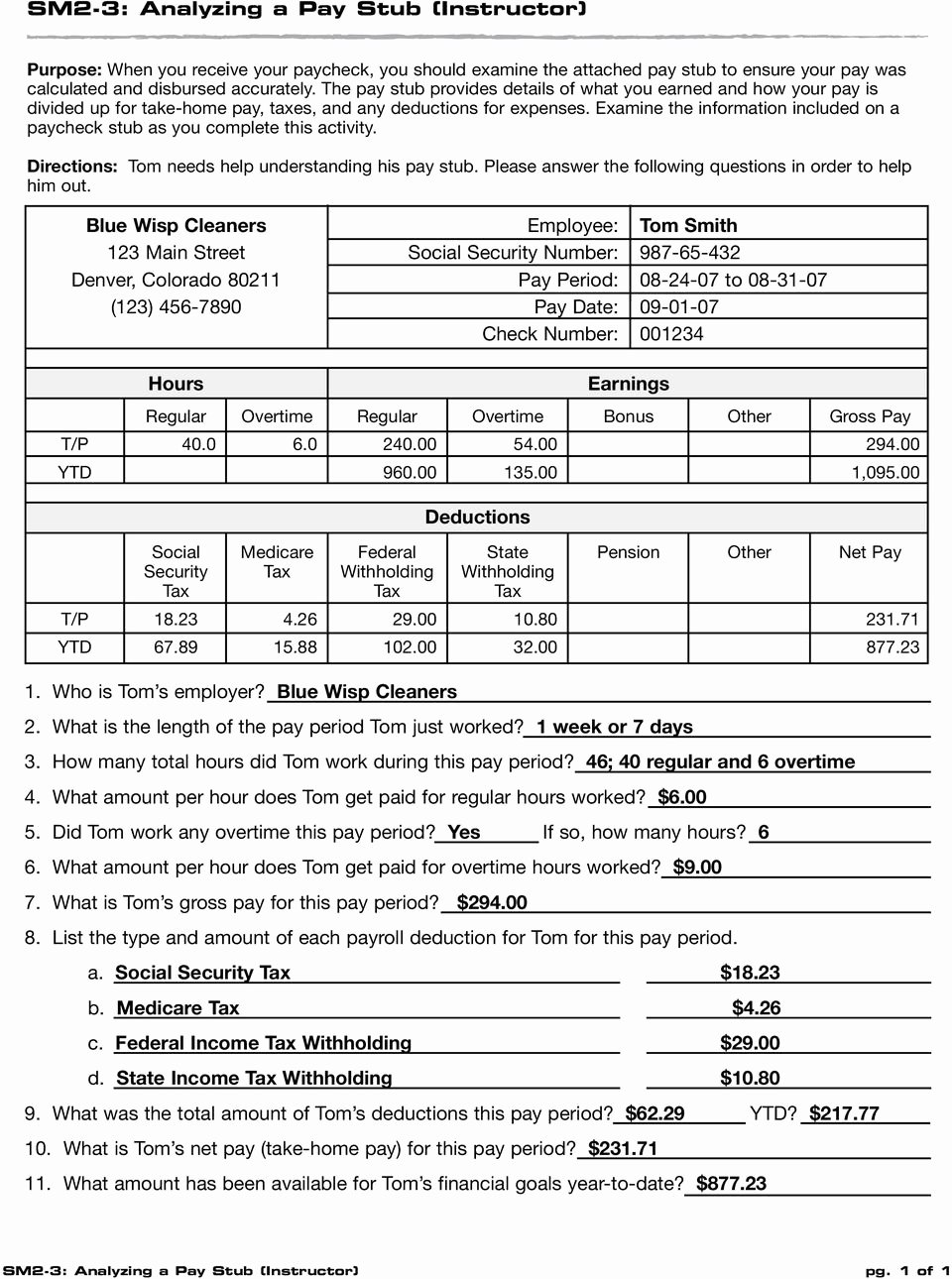

Image: studydbforster.z13.web.core.windows.net

Harnessing Technological Tools

In today’s digital age, numerous online tools and apps can further enhance your understanding of pay stubs. Many financial institutions offer online platforms where you can access detailed pay stub information, download historical statements, and analyze your financial trends.

There are also specialized apps designed to help you interpret your pay stub, calculate taxes, and create personalized budgets. These tools can simplify the process of understanding your finances and unlock valuable insights to improve your financial wellbeing.

Reading A Pay Stub Ramsey Answer Key

A Final Word: Owning Your Financial Power

Understanding your pay stub isn’t a complex endeavor. It’s about taking control of your finances, making informed decisions, and ultimately securing a brighter future for yourself and your loved ones. Remember, knowledge is power when it comes to your money. By embracing the knowledge gained from your pay stub, you step onto a path toward financial freedom and security.

Take the time to study your pay stub, ask questions, and utilize the available resources. You may be surprised by the insights you gain and the positive changes you can implement in your finances. Your journey to financial well-being starts with you, and your pay stub holds the key to unlocking your potential.