Have you ever felt like you’re constantly chasing the next big investment, only to find yourself trailing behind the market? It’s a common frustration for investors, but what if there was a way to consistently identify stocks that are poised for outperformance?

Image: www.chegg.com

Enter relative strength, a powerful investment criterion that can help you navigate the choppy waters of the stock market. Instead of focusing solely on a stock’s individual performance, relative strength analyzes how a stock performs compared to its peers and the broader market. It’s a strategy that can provide valuable insights into which investments are truly outperforming and have the potential for sustained growth.

What is Relative Strength?

In essence, relative strength measures how well an investment is doing compared to a benchmark or a group of similar investments. It’s a comparative approach to investment analysis, allowing you to understand how a specific stock or asset class is performing against a defined point of reference.

For example, let’s imagine you’re considering investing in two companies: Company A and Company B, both within the technology sector. While Company A may show impressive growth in its own right, Company B might outperform Company A by a significant margin over a given period. This superior performance of Company B relative to Company A makes it the “stronger” investment despite the growth of both companies.

Applying Relative Strength in the Real World

Relative strength isn’t just a theoretical concept; it’s a practical tool used by professional investors and traders worldwide. Consider these real-world examples:

1. Sector Rotation:

Imagine the energy sector is experiencing significant growth. Relative strength analysis can help you identify the strongest performing companies within that sector. By focusing on stocks that are outperforming their peers in a rising sector, you can capitalize on the upward trend without taking any unnecessary risks.

Image: voguestock.co.in

2. Identifying Growth Stocks:

Relative strength is an invaluable tool for growth investors looking for companies with strong momentum. Identifying stocks that are consistently outperforming the market and their peers suggests they’re likely to continue their upward trajectory. The “relative” aspect allows you to separate the true winners from the pretenders.

3. Managing Portfolio Risk:

Relative strength can help you diversify your portfolio by identifying stocks with different strengths. It’s about finding both “winners” and “losers,” but in a controlled way. By balancing strong performers with potential laggards, you can create a portfolio that’s less susceptible to market volatility.

Methods to Measure Relative Strength

There are various methods to quantify relative strength, each with its unique advantages and drawbacks.

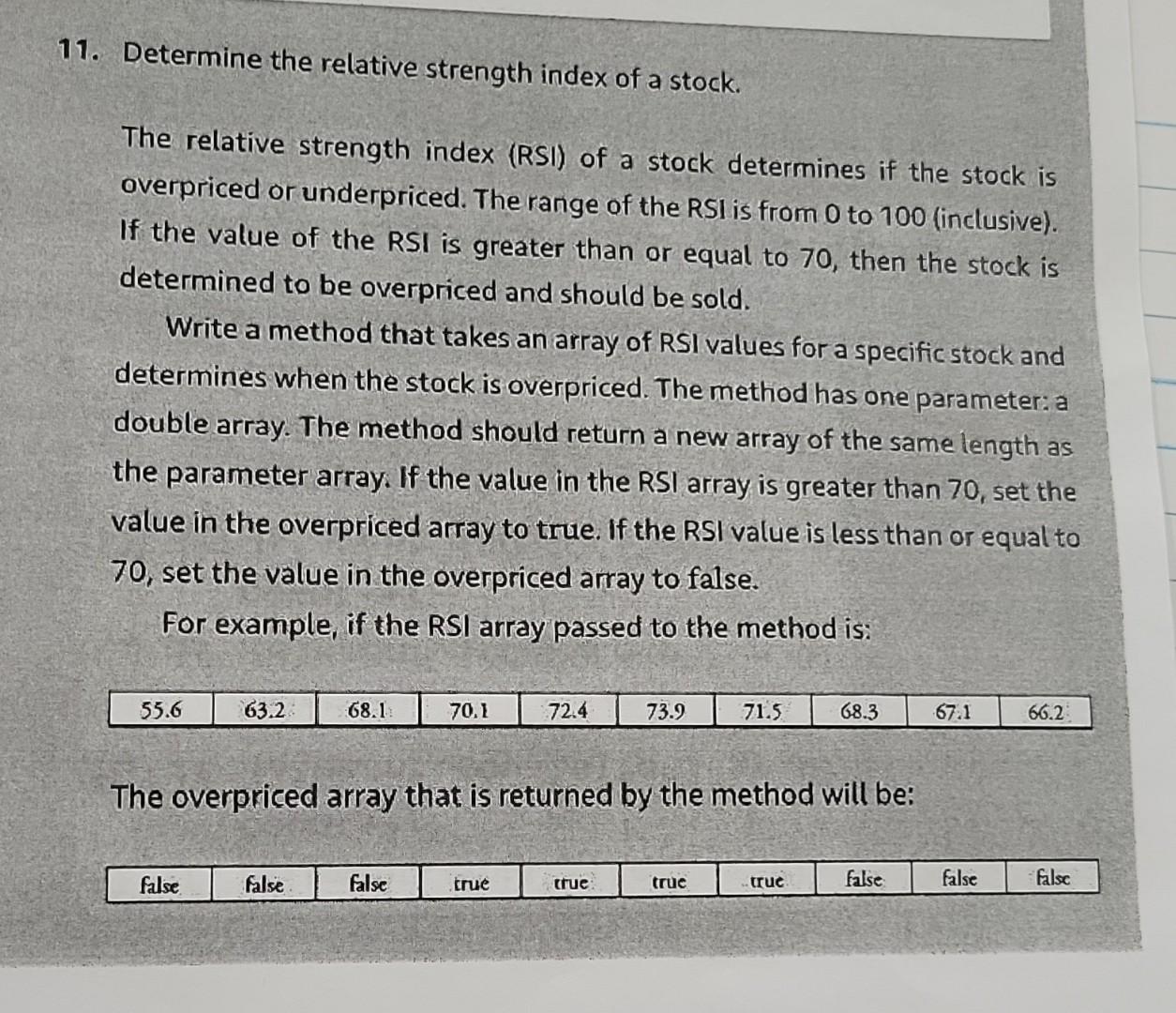

1. Relative Strength Index (RSI):

One of the most popular techniques is the Relative Strength Index (RSI), a technical indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or asset. RSI values range from 0 to 100, with readings above 70 considered overbought and readings below 30 considered oversold. While RSI is primarily a momentum indicator, it can also be used to identify relative strength trends.

2. Price Performance Charts:

Simple price charts can help visualize relative strength by comparing the price movement of a particular stock to a benchmark index like the S&P 500. If a stock is consistently outperforming the index over time, it demonstrates relative strength. This method is especially useful for spotting long-term patterns and trends.

3. Peer Group Comparison:

Comparing a stock’s performance to its peers within the same industry or sector using financial ratios and metrics can provide a clearer picture of relative strength. For instance, if one company’s earnings growth rate is significantly higher than its competitors, it indicates a strong relative performance.

Relative Strength: More Than Just Charts

While technical indicators and chart analysis are valuable tools, relative strength analysis goes beyond these superficial metrics. It involves a deeper understanding of the underlying factors driving a stock’s performance, including:

1. Industry Dynamics:

A stock may exhibit relative strength because its underlying industry is experiencing exceptional growth. For instance, during the global shift towards renewable energy, solar power companies have demonstrated strong relative strength compared to traditional energy giants.

2. Company Fundamentals:

Relative strength analysis shouldn’t be divorced from fundamental analysis. Examine a company’s financial performance, earnings potential, competitive landscape, and management quality to understand why it’s outperforming its peers. This fundamental analysis will provide a foundation for your relative strength assessments.

3. Investor Sentiment:

Investor sentiment also plays a role in relative strength. A stock that’s attracting significant interest from investors is likely to show stronger price performance than those with limited market participation. Analyzing investor sentiment can provide valuable insights into the relative strength of a particular investment.

Cautionary Notes and Pitfalls

Despite its benefits, relative strength analysis is not a foolproof system. Like any investment strategy, it comes with potential pitfalls and limitations. It’s important to be aware of these:

1. Past Performance is Not Guarantees Future Results:

The fact that a stock has displayed strong relative strength in the past doesn’t automatically guarantee future success. Market conditions change, and companies can face unforeseen challenges. Overreliance on past performance as the sole indicator of future strength can lead to costly mistakes.

2. Short-Term Fluctuations:

Relative strength can be susceptible to short-term fluctuations. While a stock may show impressive strength in the short run, this doesn’t mean it will continue to outperform long-term. This can happen due to market volatility, temporary growth spurts, or fundamental changes in the underlying business.

3. Oversimplified Metrics:

Using overly simplified metrics like RSI alone can neglect other crucial factors driving a stock’s performance. Focus on a comprehensive approach that combines relative strength indicators with fundamental analysis, considering industry dynamics, investor sentiment, and other relevant variables.

Relative Strength As A Criterion For Investment Selection

The Power of Relative Strength: A Consistent Edge

Relative strength analysis isn’t a magic bullet, but it can be a powerful tool in your investment arsenal. When applied judiciously, it can provide you with a consistent edge in navigating the complexities of the stock market. By identifying stocks that are outperforming their peers, you can increase your odds of finding investments with the potential for strong returns.

Remember, relative strength analysis should be used as a complementary tool, not a sole indicator. Integrate it with your fundamental analysis and consider all aspects of an investment before making a decision. With diligent research and a well-rounded approach, you can unlock the power of relative strength to navigate the world of investing with greater confidence.